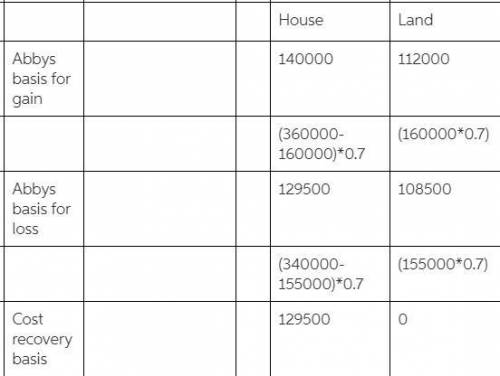

Abby's home had a basis of $360,000 ($160,000 attributable to the land) and a fair market value of $340,000 ($155,000 attributable to the land) when she converted 70% of it to business use by opening a bed-and-breakfast. Four years after the conversion, Abby sells the home for $500,000 ($165,000 attributable to the land).

Calculate Abby's basis for gain, loss, and cost recovery for the portion of her personal residence that was converted to business use.

Answers: 1

Another question on Business

Business, 21.06.2019 23:30

Starting at age 30, you deposit $2000 a year into an ira account for retirement. treat the yearly deposits into the account as a continuous income stream. if money in the account earns 7%, compounded continuously, how much will be in the account 35 years later, when you retire at age 65? how much of the final amount is interest?

Answers: 2

Business, 22.06.2019 04:30

Jennifer purchased a house in a brand new development in the outskirts of town. when her house was built, the nearest fire department was nearly 20 miles away. as her neighborhood developed, the density of the community called for a new fire department 1.5 miles away. what effect will the new fire station have on her homeowners insurance premium? a. a new fire department will be more demanding on local taxes. her annual premium will go up. b. the location of a fire department has no bearing on the value of her house. her annual premium will stay the same. c. the new fire department will reduce the risk of financial loss in her home. her annual premium should decrease. d. with a fire department so close (less than 5 miles), financial risk on jennifer’s home practically disappears. she will not need to pay insurance anymore.

Answers: 1

Business, 22.06.2019 05:30

Excel allows you to take a lot of data and organize it in one document. what are some of the features you can use to clarify, emphasize, and differentiate your data?

Answers: 2

You know the right answer?

Abby's home had a basis of $360,000 ($160,000 attributable to the land) and a fair market value of $...

Questions

Biology, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

History, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

Mathematics, 03.09.2019 05:20

Social Studies, 03.09.2019 05:20

Social Studies, 03.09.2019 05:20

Computers and Technology, 03.09.2019 05:20