Business, 16.03.2020 22:11 marieknight689

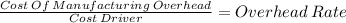

Budgeted sales revenue $ 205,000 Actual manufacturing overhead 364,000 Budgeted machine hours (based on practical capacity) 20,000 Budgeted direct-labor hours (based on practical capacity) 20,000 Budgeted direct-labor rate $ 13 Budgeted manufacturing overhead $ 336,000 Actual machine hours 11,000 Actual direct-labor hours 18,000 Actual direct-labor rate $ 16 Required: Prepare a journal entry to add to work-in-process inventory the total manufacturing overhead cost for the year, assuming: 1. The firm uses actual costing. 2. The firm uses normal costing, with a predetermined overhead rate based on machine hours. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Answers: 2

Another question on Business

Business, 21.06.2019 21:50

The next dividend payment by savitz, inc., will be $2.08 per share. the dividends are anticipated to maintain a growth rate of 6 percent forever. if the stock currently sells for $42 per share, what is the required return?

Answers: 2

Business, 22.06.2019 03:30

Nellie lumpkin, who suffered from dementia, was admitted to the picayune convalescent center, a nursing home. because of her mental condition, her daughter, beverly mcdaniel, signed the admissions agreement. it included a clause requiring the par- ties to submit any dispute to arbitration. after lumpkin left the center two years later, she filed a suit against picayune to recover damages for mistreatment and malpractice. [covenant health & rehabilitation of picayune, lp v. lumpkin, 23 so.2d 1092 (miss. app. 2009)] (see page 91.) 1. is it ethical for this dispute—involving negligent medical care, not a breach of a commercial contract—to be forced into arbitration? why or why not? discuss whether medical facilities should be able to impose arbitration when there is generally no bargaining over such terms.

Answers: 3

Business, 22.06.2019 10:50

Suppose that a firm is considering moving from a batch process to an assembly-line process to better meet evolving market needs. what concerns might the following functions have about this proposed process change: marketing, finance, human resources, accounting, and information systems?

Answers: 2

Business, 22.06.2019 15:30

In 2015, lori assigned a paid-up whole life insurance policy to an irrevocable life insurance trust (ilit) for the benefit of her three children. the ilit contained a crummey provision for the benefit of each child. at the time of the transfer, the whole life insurance policy was valued at $200,000, and since lori had not made any other taxable gifts during her lifetime, she did not owe any gift tax. lori died in 2016, and the face value of the whole life insurance policy of $2,000,000 was paid to the ilit. regarding this transfer, how much is included in lori’s gross estate at her death?

Answers: 1

You know the right answer?

Budgeted sales revenue $ 205,000 Actual manufacturing overhead 364,000 Budgeted machine hours (based...

Questions

Spanish, 27.06.2019 17:30

Health, 27.06.2019 17:30

English, 27.06.2019 17:30

Physics, 27.06.2019 17:30

Mathematics, 27.06.2019 17:30

Biology, 27.06.2019 17:30

Mathematics, 27.06.2019 17:30

English, 27.06.2019 17:30

Chemistry, 27.06.2019 17:30