Business, 16.03.2020 21:20 villarrealc1987

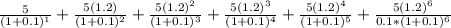

Consider the following three stocks: a. Stock A is expected to provide a dividend of $10 a share forever. b. Stock B is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 4% a year forever. c. Stock C is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 20% a year for five years (i. e., years 2 through 6) and zero thereafter. If the market capitalization rate for each stock is 10%, which stock is the most valuable

Answers: 3

Another question on Business

Business, 22.06.2019 01:10

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

Business, 22.06.2019 20:00

Richard is one of the leading college basketball players in the state of florida. he also maintains a good academic record. looking at his talent and potential, furman university offers to bear the expenses for his college education.

Answers: 3

Business, 22.06.2019 22:00

Most economists report the elasticity of demand asa. the absolute value of the actual number.b. a negative number, since price and quantity demanded move in opposite directions.c. a percentage, since both the numerator and denominator are percentages.d. a dollar amount, since we are measuring the change in price.

Answers: 2

Business, 23.06.2019 01:00

What is the average price for the cordless telephones (to 2 decimals)? $ b. what is the average talk time for the cordless telephones (to 3 decimals)? hours c. what percentage of the cordless telephones have a voice quality of excellent? % d. what percentage of the cordless telephones have a handset on the base?

Answers: 3

You know the right answer?

Consider the following three stocks: a. Stock A is expected to provide a dividend of $10 a share for...

Questions

History, 23.06.2019 20:50

SAT, 23.06.2019 20:50

Mathematics, 23.06.2019 20:50

History, 23.06.2019 20:50

Mathematics, 23.06.2019 20:50

Mathematics, 23.06.2019 20:50

Mathematics, 23.06.2019 20:50

History, 23.06.2019 20:50

Mathematics, 23.06.2019 20:50

History, 23.06.2019 20:50

Advanced Placement (AP), 23.06.2019 20:50

Mathematics, 23.06.2019 20:50

=

=