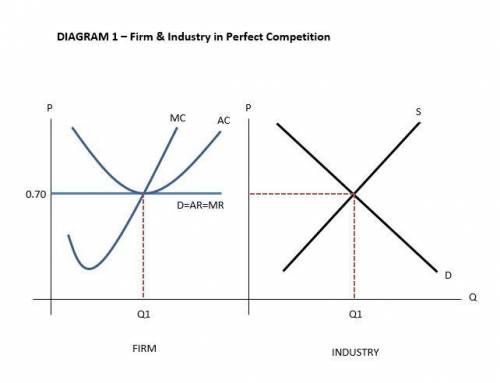

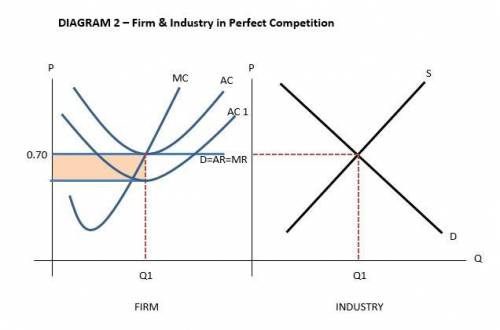

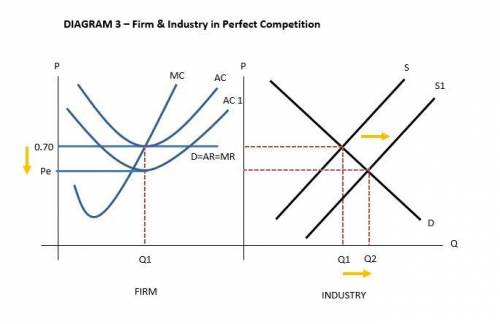

Suppose five years from now that the ranching industry is in long-run equilibrium at 70 cents per pound. Graphically illustrate what that would look like for the ranching industry using side-by-side industry and firm graphs. Then, suppose a new hormone shot is developed at Texas A&M University that allows all ranchers to cut their feed costs by 27 percent if they use this shot. Graphically illustrate the short-run implications of this development in the ranching industry using a new set of side-by-side industry and firm graphs. Explain your answer. Graphically illustrate the long-run implications of this development in the ranching industry using a new set of side-by-side industry and firm graphs. Explain your answer.

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

Walter wants to deposit $1,500 into a certificate of deposit at the end of each ofthe next 6 years. the deposits will earn 5 percent compound annual interest. ifwalter follows through with his plan, approximately how much will be in his accountimmediately after the sixth deposit is made?

Answers: 1

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 17:50

Variable rate cd’s = $90 treasury bills = $150 discount loans = $20 treasury notes = $100 fixed rate cds = $160 money market deposit accts. = $140 savings deposits = $90 fed funds borrowing = $40 variable rate mortgage loans $140 demand deposits = $40 primary reserves = $50 fixed rate loans = $210 fed funds lending = $50 equity capital = $120 a. develop a balance sheet from the above data. be sure to divide your balance sheet into rate-sensitive assets and liabilities as we did in class and in the examples. b. perform a standard gap analysis and a duration analysis using the above data if you have a 1.15% decrease in interest rates and an average duration of assets of 5.4 years and an average duration of liabilities of 3.8 years. c. indicate if this bank will remain solvent after the valuation changes. if so, indicate the new level of equity capital after the valuation changes. if not, indicate the amount of the shortage in equity capital.

Answers: 3

Business, 23.06.2019 00:40

On june 3, teal company sold to chester company merchandise having a sale price of $2,600 with terms of 2/10, n/60, f.o.b. shipping point. an invoice totaling $91, terms n/30, was received by chester on june 8 from john booth transport service for the freight cost. on june 12, the company received a check for the balance due from chester company. prepare journal entries on the teal company books to record all the events noted above under each of the following bases. (1) sales and receivables are entered at gross selling price. (2) sales and receivables are entered at net of cash discounts.

Answers: 3

You know the right answer?

Suppose five years from now that the ranching industry is in long-run equilibrium at 70 cents per po...

Questions

History, 29.01.2021 02:00

Health, 29.01.2021 02:00

Medicine, 29.01.2021 02:00

Mathematics, 29.01.2021 02:00

Mathematics, 29.01.2021 02:00

Business, 29.01.2021 02:00

Mathematics, 29.01.2021 02:00

Social Studies, 29.01.2021 02:00

Chemistry, 29.01.2021 02:00

Mathematics, 29.01.2021 02:00