Business, 12.03.2020 03:10 masterdavey3691

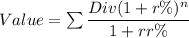

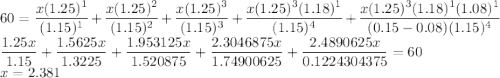

Experiencing rapid growth. Dividends are expected to grow at 25 percent per year during the next three years, 18 percent over the following year, and then 8 percent per year, indefinitely. The required return on this stock is 15 percent, and the stock currently sells for $60.00 per share. What is the projected dividend for the coming year

Answers: 1

Another question on Business

Business, 22.06.2019 12:00

Need today! will get brainliest for right answer! compare and contrast absolute advantage and comparative advantage.

Answers: 1

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 16:20

The assumptions of the production order quantity model are met in a situation where annual demand is 3650 units, setup cost is $50, holding cost is $12 per unit per year, the daily demand rate is 10 and the daily production rate is 100. the production order quantity for this problem is approximately:

Answers: 1

You know the right answer?

Experiencing rapid growth. Dividends are expected to grow at 25 percent per year during the next thr...

Questions

Physics, 14.11.2020 06:40

Physics, 14.11.2020 06:40

History, 14.11.2020 06:40

Mathematics, 14.11.2020 06:40

Mathematics, 14.11.2020 06:40

Spanish, 14.11.2020 06:40

History, 14.11.2020 06:40

Social Studies, 14.11.2020 06:40

Mathematics, 14.11.2020 06:40

Mathematics, 14.11.2020 06:40

Chemistry, 14.11.2020 06:40

Chemistry, 14.11.2020 06:40

Chemistry, 14.11.2020 06:40