Business, 11.03.2020 17:06 khalibarnes001

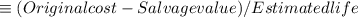

On January 1, 2017, Anodel, Inc. acquired a machine for $1,010,000. The estimated useful life of the asset is five years. Residual value at the end of five years is estimated to be $62,000. Calculate the depreciation expense per year using the straight-line method.

Answers: 2

Another question on Business

Business, 22.06.2019 12:40

Alarge tank is filled to capacity with 500 gallons of pure water. brine containing 2 pounds of salt per gallon is pumped into the tank at a rate of 5 gal/min. the well-mixed solution is pumped out at the same rate. find the number a(t) of pounds of salt in the tank at time t.

Answers: 3

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 16:30

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

Business, 23.06.2019 17:50

Suppose that georgiania was a thriving empire in its golden age. business was booming and it was the center of international trade under the leadership of emperor raphael iii. his empire's pride and joy was the trading of green and black tea, and he decreed that their entire economy should be built around it. however, in the mid 1800s, georgiania experienced a severe economic downturn when the other nations of the world created an embargo on tea from georgiania, which led to civil strife due to thousands of workers being laid off.a downward fluctuation in the economy like this is known as a )the correct term is a key component )

Answers: 2

You know the right answer?

On January 1, 2017, Anodel, Inc. acquired a machine for $1,010,000. The estimated useful life of the...

Questions

Mathematics, 09.12.2021 05:50

Mathematics, 09.12.2021 05:50

Mathematics, 09.12.2021 05:50

Mathematics, 09.12.2021 05:50

World Languages, 09.12.2021 05:50

Mathematics, 09.12.2021 05:50

Mathematics, 09.12.2021 05:50

History, 09.12.2021 05:50

Social Studies, 09.12.2021 05:50

Mathematics, 09.12.2021 05:50