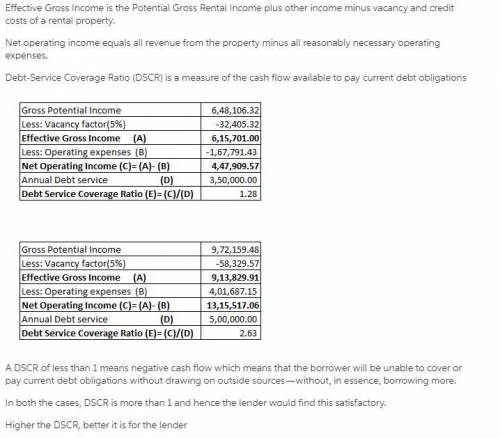

An apartment complex has a gross rental income of $648,106.32 and total operating expenses of $167,791.43. The vacancy factor is 5%, and the annual debt service (P&I for the loan) is $350,000 Calculate: Effective Gross Income, Net Operating Income and the Debt Service Coverage Ratio (DSCR). Use the format we used in class and show all your work. Based on what we discussed in class, would a lender find this DSCR satisfactory? Why or why not?

Answers: 3

Another question on Business

Business, 22.06.2019 02:40

Which of the following statements about brand names is true? brand names give the seller an incentive to provide consistently high-quality products and services in order to protect the reputation of the brand. brand names are always economically wasteful since they dupe consumers into buying more expensive goods and services that are no different from generic versions. it is always rational to prefer brand names over generic substitutes. read the following example and determine whether it illustrates a common critique or defense of advertising. musashi sees a commercial for a brand x clothing company that depicts the wearers of the clothes out having a good time with friends. although he doesn't particularly need new clothes, the commercial prompts him to buy a brand x t-shirt.

Answers: 3

Business, 22.06.2019 03:10

Beswick company your team is allocated a project involving a major client, the beswick company. although the organization has many clients, this client, and project, is the largest source of revenue and affects the work of several other teams in the organization. the project requires continuous involvement with the client, so any problems with the client are immediately felt by others in the organization. jamie, a member of your team, is the only person in the company with whom this client is willing to deal. it can be said that jamie has:

Answers: 2

Business, 22.06.2019 06:50

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

You know the right answer?

An apartment complex has a gross rental income of $648,106.32 and total operating expenses of $167,7...

Questions

Mathematics, 13.01.2021 22:20

English, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20

Mathematics, 13.01.2021 22:20