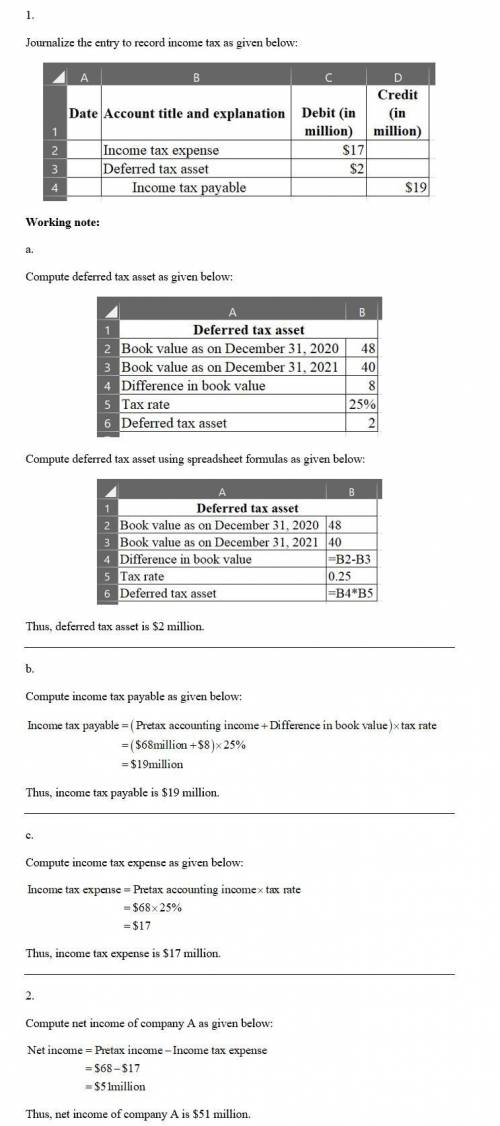

On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $54 million. Ameen uses straight-line depreciation for financial statement reporting and deducted 100% of the equipment’s cost for income tax reporting in 2018. At December 31, 2020, the book value of the equipment was $48 million. At December 31, 2021, the book value of the equipment was $40 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2021 was $68 million. Required: 1. Prepare the appropriate journal entry to record Ameen’s 2021 income taxes. Assume an income tax rate of 25%. 2. What is Ameen’s 2021 net income?

Answers: 1

Another question on Business

Business, 21.06.2019 18:10

In a sumif conditional function, what should be the order of terms in the parentheses?

Answers: 1

Business, 22.06.2019 03:00

Match each item to check for while reconciling a bank account with the document to which it relates. (there's not just one answer) 1. balancing account statement 2. balancing check register a. nsf fees b. deposits in transit c. interest earned d. bank errors

Answers: 3

Business, 22.06.2019 03:30

Joe said “your speech was really great, i loved it.” his criticism lacks which component of effective feedback? a) he did not recognize his ethical obligations b) he did not focus on behavior c) he did not stress the positive d) he did not offer any specifics

Answers: 2

Business, 22.06.2019 10:30

True or false: a fitted model with more predictors will necessarily have a lower training set error than a model with fewer predictors.

Answers: 2

You know the right answer?

On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $...

Questions

Mathematics, 22.05.2020 02:02

History, 22.05.2020 02:02

English, 22.05.2020 02:02

Chemistry, 22.05.2020 02:02

Mathematics, 22.05.2020 02:02

Mathematics, 22.05.2020 02:02

Mathematics, 22.05.2020 02:02

Mathematics, 22.05.2020 02:02

English, 22.05.2020 02:02