Business, 10.03.2020 08:15 rosezgomez97

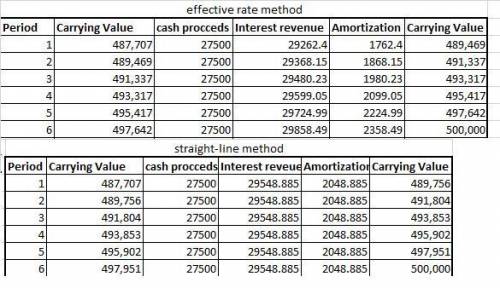

Tudor Company acquired $500,000 of Carr Corporation bonds for $487,706.69 on January 1, 2019. The bonds carry an 11% stated interest rate, pay interest semiannually on January 1 and July 1, were issued to yield 12%, and are due January 1, 2022.Required:

1. Prepare an investment interest income and discount amortization schedule using the:a. straight-line method

b. effective interest method

2. Prepare the July 1, 2021, journal entries to record the interest income under both methods.

Answers: 3

Another question on Business

Business, 21.06.2019 16:30

Which economic system could be characterized by the "iron fist", meaning a central authority figure has control over most of the economy? market economy command economy traditional economy free enterprise economy

Answers: 3

Business, 21.06.2019 22:40

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 22.06.2019 09:40

Wilson center is a private not-for-profit voluntary health and welfare entity. during 2017, it received unrestricted pledges of $638,000, 65 percent of which were payable in 2017, with the remainder payable in 2018 (for use in 2018). officials estimate that 14 percent of all pledges will be uncollectible. a. how much should wilson center report as contribution revenue for 2017? b. in addition, a local social worker, earning $20 per hour working for the state government, contributed 600 hours of time to wilson center at no charge. without these donated services, the organization would have hired an additional staff person. how should wilson center record the contributed service?

Answers: 2

Business, 22.06.2019 11:40

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

You know the right answer?

Tudor Company acquired $500,000 of Carr Corporation bonds for $487,706.69 on January 1, 2019. The bo...

Questions

Chemistry, 04.07.2019 03:30

Biology, 04.07.2019 03:30

Mathematics, 04.07.2019 03:30

Biology, 04.07.2019 03:30

History, 04.07.2019 03:30

Mathematics, 04.07.2019 03:30

Chemistry, 04.07.2019 03:30

History, 04.07.2019 03:30