Business, 10.03.2020 07:04 hrijaymadathil

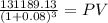

Calvin Excellenza is a new manufacturing start-up at a university city. The firm is introducing an innovative scooter based on the market survey among college students. The company plans to obtained a loan of $350000 from a bank at an interest rate of 8% to procure and install the equipment needed to start the production. Calvin assumes that the scooter will sell for the next seven years before a new design is introduced. It was estimated that 800 units will be sold in the first year. Furthermore, the volume of sales is expected to increase by 8% for the next 3 years at which time the sales will reach its peak. Afterward, it is expected that the sales will decline at a rate of 10% for the next 3 years. A unit of the product will be sold for $130 in the first year and the he price will then increase by 4% annually for the next three years. During the period of the expected declining sales (the remaining three years), the price will be reduced by 5% annually. Determine the present worth of this investment and decide if this investment is worthwhile.

Answers: 3

Another question on Business

Business, 22.06.2019 12:10

This exercise illustrates that poor quality can affect schedules and costs. a manufacturing process has 130 customer orders to fill. each order requires one component part that is purchased from a supplier. however, typically, 3% of the components are identified as defective, and the components can be assumed to be independent. (a) if the manufacturer stocks 130 components, what is the probability that the 130 orders can be filled without reordering components? (b) if the manufacturer stocks 132 components, what is the probability that the 130 orders can be filled without reordering components? (c) if the manufacturer stocks 135 components, what is the probability that the 130 orders can be filled without reordering components?

Answers: 3

Business, 22.06.2019 16:40

Consider two similar industries, portal crane manufacturing (pcm) and forklift manufacturing (flm). the pcm industry has exactly three incumbents with annual sales of $800 million, $200 million and $100 million, respectively. the flm industry has also exactly three incumbents, with annual sales of $500 million, $450 million and $400 million, respectively. which industry is more likely to experience a higher level of rivalry?

Answers: 3

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

Business, 22.06.2019 22:40

Effective capacity is the: a. capacity a firm expects to achieve given the current operating constraints.b. minimum usable capacity of a particular facility.c. sum of all the organization's inputs.d. average output that can be achieved under ideal conditions.e. maximum output of a system in a given period.

Answers: 1

You know the right answer?

Calvin Excellenza is a new manufacturing start-up at a university city. The firm is introducing an i...

Questions

Medicine, 01.06.2021 17:40

Biology, 01.06.2021 17:40

Mathematics, 01.06.2021 17:40

Mathematics, 01.06.2021 17:40

Health, 01.06.2021 17:40

Mathematics, 01.06.2021 17:40

Mathematics, 01.06.2021 17:40

Biology, 01.06.2021 17:40

Mathematics, 01.06.2021 17:40

Physics, 01.06.2021 17:40

Mathematics, 01.06.2021 17:40

Computers and Technology, 01.06.2021 17:40

Mathematics, 01.06.2021 17:40

![\left[\begin{array}{ccccc}Year&Price&Units&Revenue&PV\\1&130&800&104000&96296.3\\2&135.2&864&116812.8&100148.15\\3&140.61&933&131189.13&104142.16\\4&146.23&1008&147399.84&108343.28\\5&138.92&907&126000.44&85753.78\\6&131.97&816&107687.52&67861.4\\7&125.37&734&92021.58&53693.71\\&&&Total&616238.78\\\end{array}\right]](/tpl/images/0540/2913/bdbc3.png)