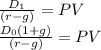

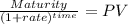

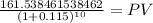

"Finance3000" is a young start-up company. It will not pay any dividends on its stock over the next nine years because it plans to use retained earnings on expanding its business. "Finance3000" will pay a $10 per share dividend 10 years from today. After that the company will increase the dividend by 5 percent per year, in perpetuity. The required return on this stock is 11.5 percent. Calculate the value of one share of "Finance3000"'s stock. (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

Hours to produce one unit worker hours to produce yarn country a 8 hours country b 4 hours worker hours to produce fabric counrty a 12 hours country b 13 hours additional worker hours to produce fabric instead of yarn country a ? country b? which of the follow is true of the trade relationship between country a and country b? country a has an absolute advantage in producing yarn and fabric country b has an absolute advantage in producing yarn and fabric country b has a comparative advantage to country a in producing fabric country a has a comparative advantage to country b in producing fabric

Answers: 2

Business, 22.06.2019 11:00

Which ranks these careers that employers are most likely to hire from the least to the greatest?

Answers: 2

Business, 22.06.2019 20:00

Which motion below could be made so that the chair would be called on to enforce a violated rule?

Answers: 2

Business, 22.06.2019 20:20

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

You know the right answer?

"Finance3000" is a young start-up company. It will not pay any dividends on its stock over the next...

Questions

Business, 25.04.2021 01:00

Mathematics, 25.04.2021 01:00

Mathematics, 25.04.2021 01:00

Mathematics, 25.04.2021 01:00

Mathematics, 25.04.2021 01:00

Biology, 25.04.2021 01:00

Mathematics, 25.04.2021 01:00

English, 25.04.2021 01:00

Mathematics, 25.04.2021 01:00