Business, 10.03.2020 02:02 nicollexo21

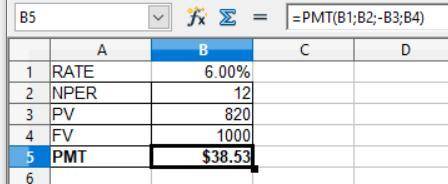

A coupon bond with 12 years remaining to maturity has a yield to maturity of 6% and a face value of $1,000 that is returned to the bondholder at maturity. The bond has a current price of $820.

Which of the following comes closest to the coupon payment of this bond?

A) $32.98 B) $38.53 C) $40.92 D) $43.30 E) $45.69

Answers: 2

Another question on Business

Business, 22.06.2019 20:00

Ajax corp's sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. what was the firm's times-interest-earned (tie) ratio? a. 4.72b. 4.97c. 5.23d. 5.51e. 5.80

Answers: 1

Business, 23.06.2019 11:00

What are the factors that affects on the process of planning

Answers: 3

Business, 24.06.2019 01:30

Is defined as a "flaw or weakness in system security procedures, design, implementation, or internal controls that could be exercised (accidentally triggered or intentionally exploited) and result in a security breach or violation of the system's security policy."?

Answers: 1

Business, 24.06.2019 02:00

Agrocery store is running a "buy-one-get-another-at-one-half-off" promotion on a dozen doughnuts. so the first dozen is $6 and the second would be $3. a person would buy the second dozen if their marginal benefit from the second dozen doughnuts is:

Answers: 2

You know the right answer?

A coupon bond with 12 years remaining to maturity has a yield to maturity of 6% and a face value of...

Questions

Biology, 01.08.2019 18:50

Physics, 01.08.2019 18:50

Mathematics, 01.08.2019 18:50

Health, 01.08.2019 18:50

History, 01.08.2019 18:50

Mathematics, 01.08.2019 18:50