Business, 10.03.2020 00:58 smilingntn33p7pqpp

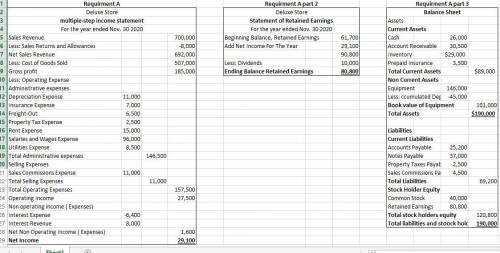

The Deluxe Store is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the company's fiscal year on November 30, 2020, the following accounts appeared in two of its trial balances.

Unadjusted Adjusted

Accounts Payable $25,200 $25,200

Accounts Receivable 30,500 30,500

Accumulated Depr.—Equip. 34,000 45,000

Cash 26,000 26,000

Common Stock 40,000 40,000

Cost of Goods Sold 507,000 507,000

Dividends 10,000 10,000

Freight-Out 6,500 6,500

Equipment 146,000 146,000

Depreciation Expense 11,000

Insurance Expense 7,000

Interest Expense 6,400 6,400

Interest Revenue 8,000 8,000

Inventory $29,000 $29,000

Notes Payable 37,000 37,000

Prepaid Insurance 10,500 3,500

Property Tax Expense 2,500

Property Taxes Payable 2,500

Rent Expense 15,000 15,000

Retained Earnings 61,700 61,700

Salaries and Wages Expense 96,000 96,000

Sales Commissions Expense 6,500 11,000

Sales Commissions Payable 4,500

Sales Returns and Allowances 8,000 8,000

Sales Revenue 700,000 700,000

Utilities Expense 8,500 8,500

A. Prepare a multiple-step income statement, a retained earnings statement, and a classified balance sheet. Notes payable are due in 2018. (Check Figures: Net Income $29,100 Retained Earnings $80,800 Total Assets $190,000)

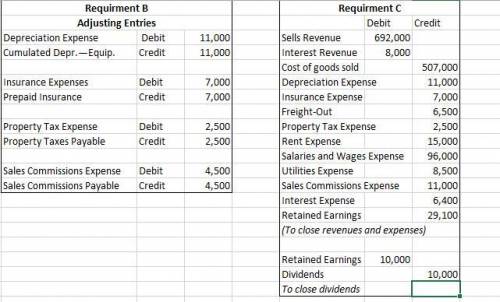

B. Journalize the adjusting entries that were made.

C. Journalize the closing entries that are necessary.

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 22.06.2019 13:30

Jose recently died with a probate estate of $900,000. he was predeceased by his wife, guadalupe, and his daughter, lucy. he has two surviving children, pete and fred. jose was also survived by eight grandchildren, pete’s three children, naomi, daniel, nick; fred’s three children, heather, chris and steve; and lucy’s two children, david and rachel. jose’s will states the following “i leave everything to my three children. if any of my children shall predecease me then i leave their share to their heirs, per stirpes.” which of the following statements is correct? (a) under jose’s will rachel will receive $150,000. (b) under jose’s will chris will receive $150,000. (c) under jose’s will nick will receive $100,000. (d) under jose’s will pete will receive $200,000.

Answers: 1

Business, 22.06.2019 13:30

Presented below is information for annie company for the month of march 2018. cost of goods sold $245,000 rent expense $ 36,000 freight-out 7,000 sales discounts 8,000 insurance expense 5,000 sales returns and allowances 11,000 salaries and wages expense 63,000 sales revenue 410,000 instructions prepare the income statement.

Answers: 2

Business, 22.06.2019 14:10

Carey company is borrowing $225,000 for one year at 9.5 percent from second intrastate bank. the bank requires a 15 percent compensating balance. the principal refers to funds the firm can effectively utilize (amount borrowed − compensating balance). a. what is the effective rate of interest? (use a 360-day year. input your answer as a percent rounded to 2 decimal places.) b. what would the effective rate be if carey were required to make 12 equal monthly payments to retire the loan?

Answers: 1

You know the right answer?

The Deluxe Store is located in midtown Madison. During the past several years, net income has been d...

Questions

Social Studies, 09.02.2022 07:30

Advanced Placement (AP), 09.02.2022 07:40

English, 09.02.2022 07:40

Computers and Technology, 09.02.2022 07:40

Computers and Technology, 09.02.2022 07:40

Mathematics, 09.02.2022 07:40

Health, 09.02.2022 07:40

Mathematics, 09.02.2022 07:40