Business, 10.03.2020 00:15 LilBrookilyn2701

Westwood Furniture Company is considering the purchase of two different items of equipment, as described below:

Machine A:

A compacting machine has just come onto the market that would permit Westwood Furniture Company to compress sawdust into various shelving products. At present, the sawdust is disposed of as a waste product. The following information is available on the machine:

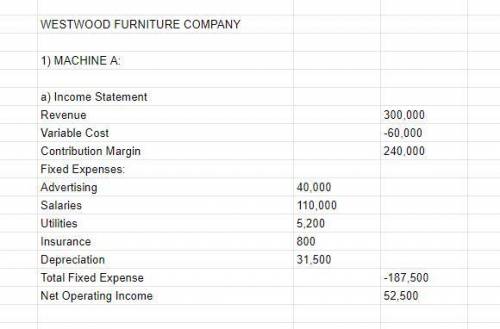

a. The machine would cost $420,000 and would have a 10% salvage value at the end of its 12-year useful life. The company uses straight-line depreciation and considers salvage value in computing depreciation deductions.

b. The shelving products manufactured from use of the machine would generate revenues of $300,000 per year. Variable manufacturing costs would be 20% of sales.

c. Fixed expenses associated with the new shelving products would be (per year): advertising, $40,000: salaries, $110,000; utilities, $5,200; and insurance, $800.

Machine B:

A second machine has come onto the market that would allow Westwood Furniture Company to automate a sanding process that is now done largely by hand. The following information is available:

a. The new sanding machine would cost $234,000 and would have no salvage value at the end of its 13-year useful life. The company would use straight-line depreciation on the new machine.

b. Several old pieces of sanding equipment that are fully depreciated would be disposed of at a scrap value of $9,000.

c. The new sanding machine would provide substantial annual savings in cash operating costs. It would require an operator at an annual salary of $16,350 and $5,400 in annual maintenance costs. The current hand-operated sanding

procedure costs the company $78,000 per year in total.

Westwood Furniture Company requires a simple rate of return of 15% on all equipment purchases. Also, the company will not purchase equipment unless the equipment has a payback period of 4.0 years or less.

Required:

1. For machine A:

a. Prepare an income statement showing the expected net operating income each year from the new shelving products. Use the contribution format.

b. Compute the simple rate of return.

c. Compute the payback period.

2. For machine B:

a. Compute the simple rate of return.

b. Compute the payback period.

3. According to the company’s criteria, which machine, if either, should the company purchase?

Answers: 1

Another question on Business

Business, 22.06.2019 17:00

Afinancing project has an initial cash inflow of $42,000 and cash flows of −$15,600, −$22,200, and −$18,000 for years 1 to 3, respectively. the required rate of return is 13 percent. what is the internal rate of return? should the project be accepted?

Answers: 1

Business, 22.06.2019 21:30

Which of the following best explains the purpose of protectionist trade policies such as tariffs and subsidies? a. they make sure that governments have enough money to pay for fiscal policies. b. they give foreign competitors access to new markets around the world. c. they allow producers to sell their products more cheaply than foreign competitors. d. they enable producers to purchase productive resources from everywhere in the world.

Answers: 1

Business, 22.06.2019 22:20

Which of the following events could increase the demand for labor? a. an increase in the marginal productivity of workers b. a decrease in the amount of capital available for workers to use c. a decrease in the wage paid to workers d. a decrease in output price

Answers: 1

You know the right answer?

Westwood Furniture Company is considering the purchase of two different items of equipment, as descr...

Questions

English, 25.04.2020 04:07

Mathematics, 25.04.2020 04:07

Mathematics, 25.04.2020 04:07

Geography, 25.04.2020 04:07

Computers and Technology, 25.04.2020 04:07

Mathematics, 25.04.2020 04:07

History, 25.04.2020 04:07