Business, 07.03.2020 05:30 fendyli1529

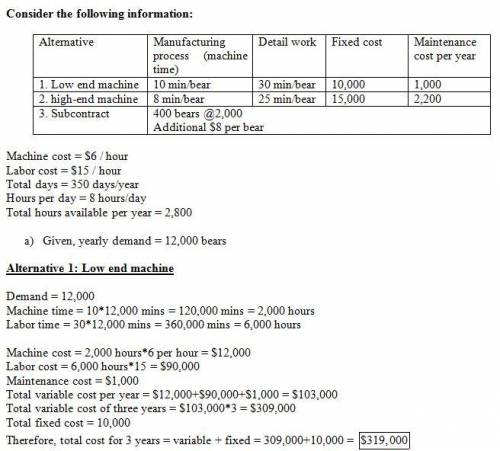

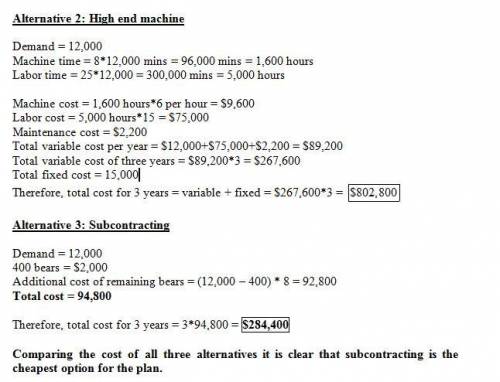

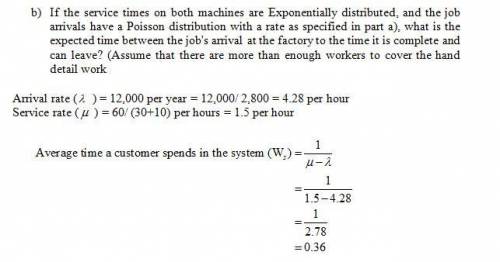

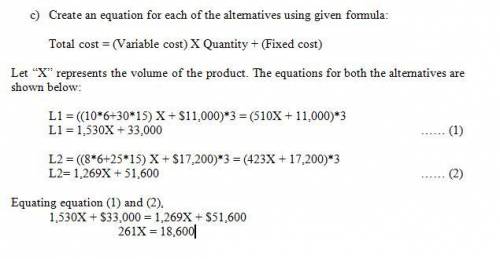

A company producing custom-made teddy bears is considering several options for expanding their existing capacity. There are 3 possibilities. The first is a low-end machine, which would take 10 minutes/bear for the (machined) manufacturing process. In addition, an average of 30 minutes of detail work would have to be done by hand (per bear). The second option is a high-end machine, which would take 8 minutes/bear, and reduce the amount of hand detail work to 25 minutes/bear. The final option is to subcontract out the bears. The subcontractor is willing to provide up to 400 bears per year for a flat fee of $2,000. Additional bears would cost $8 each. There is no difference in bear quality between the 3 options. It costs $10,000 to buy the low-end machine. Yearly maintenance is $1,000. The purchase price for the high-end machine is $15,000, while maintenance is $2,200. Management estimates the cost for running a machine at $6/hour. Labor costs are $15/hour. Assume the factory runs 350 days/year for 8 hours/day. a) If you expect a yearly demand of 12,000 bears, which option is the cheapest over a 3-year time horizon? b) If the service times on both machines are Exponentially distributed, and the job arrivals have a Poisson distribution with a rate as specified in part a), what is the expected time between the job's arrivals at the factory to the time it is complete and can leave? (Assume that there are more than enough workers to cover the hand detail work c) At what arrival rates (demand levels) would the different options make sense, given a 3-year time horizon? Please write down the answer step by step especially for parts b and c.

Answers: 2

Another question on Business

Business, 22.06.2019 08:10

Bakery has bought 250 pounds of muffin dough. they want to make waffles or muffins in half-dozen packs out of it. half a dozen of muffins requires 1 lb of dough and a pack of waffles uses 3/4 lb of dough. it take bakers 6 minutes to make a half-dozen of waffles and 3 minutes to make a half-dozen of muffins. their profit will be $1.50 on each pack of waffles and $2.00 on each pack of muffins. how many of each should they make to maximize profit, if they have just 20 hours to do everything?

Answers: 3

Business, 22.06.2019 11:30

17. chef a says that garnish should be added to a soup right before serving. chef b says that garnish should be cooked with the other ingredients in a soup. which chef is correct? a. chef a is correct. b. both chefs are correct. c. chef b is correct. d. neither chef is correct. student c incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 20:30

Data for hermann corporation are shown below: per unit percent of sales selling price $ 125 100 % variable expenses 80 64 contribution margin $ 45 36 % fixed expenses are $85,000 per month and the company is selling 2,700 units per month. required: 1-a. how much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. should the advertising budget be increased?

Answers: 1

You know the right answer?

A company producing custom-made teddy bears is considering several options for expanding their exist...

Questions

Mathematics, 31.01.2020 16:48

Chemistry, 31.01.2020 16:48

History, 31.01.2020 16:48

History, 31.01.2020 16:48

Mathematics, 31.01.2020 16:48

Mathematics, 31.01.2020 16:48

Biology, 31.01.2020 16:48

Mathematics, 31.01.2020 16:48