Business, 07.03.2020 05:30 gabbysanchez5976

Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the label Maletin Elegant and a leather briefcase produced largely through automation and sold under the label Maletin Fina. The two products use two overhead activities, with the following costs:

Setting up equipment $ 5,000

Machining 20,000

The controller has collected the expected annual prime costs for each briefcase, the machine hours, the setup hours, and the expected production.

Elegant Fina

Direct labor $9,000 $3,000

Direct materials $3,000 $3,000

Units 3,000 3,000

Machine hours 500 4,500

Setup hours 100 100

Required:

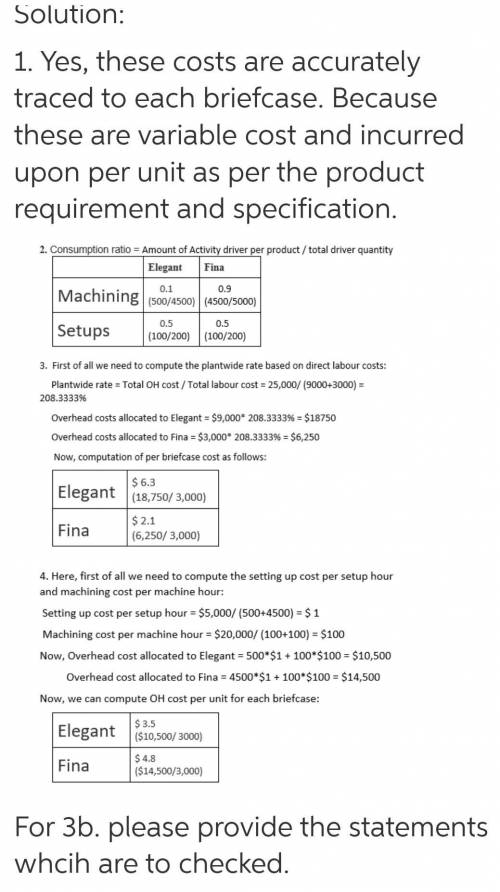

1. Conceptual Connection: Do you think that the direct labor costs and direct materials costs are accurately traced to each briefcase? Explain.

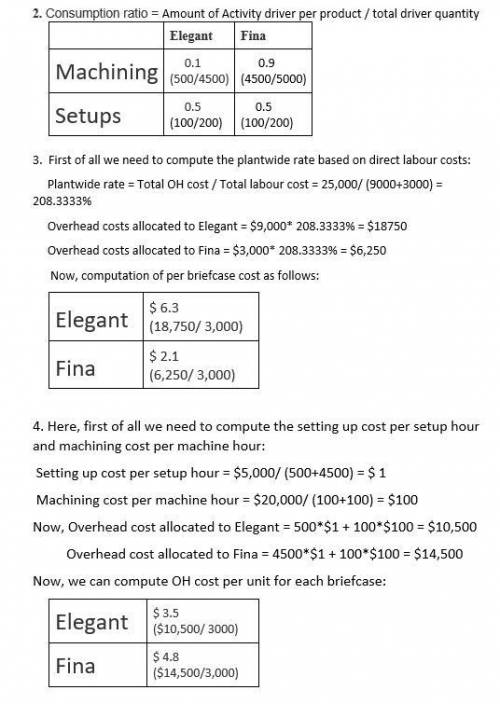

2. Calculate the consumption ratios for each activity. Round your answers to one decimal place.

Elegant Fina

Machining

Setups

3a. Calculate the overhead cost per unit for each briefcase by using a plantwide rate based on direct labor costs. Round to the nearest cent. (Note: Do not round intermediate calculations.)

Elegant $ per briefcase

Fina $ per briefcase

3b. Based on your calculations above which of the following statements is correct?

4. Conceptual Connection: Calculate the overhead cost per unit for each briefcase by using overhead rates based on machine hours and setup hours. Round your answers to the nearest cent.

Elegant $ per unit

Fina $ per unit

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Do you think a travel organization company might be able to get less expensive airline tickets then you as an individual could get? (no less then 25 words)

Answers: 1

Business, 22.06.2019 05:30

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 13:10

Lin corporation has a single product whose selling price is $136 per unit and whose variable expense is $68 per unit. the company’s monthly fixed expense is $32,400. required: 1. calculate the unit sales needed to attain a target profit of $5,000. (do not round intermediate calculations.) 2. calculate the dollar sales needed to attain a target profit of $8,400.

Answers: 3

Business, 22.06.2019 16:30

Penelope summers received certain income benefits in 2018. she received $1,400 of state unemployment insurance benefits, $2,000 from a federal unemployment trust fund and $3,700 workers’ compensation received for an occupational injury. what amount of the compensation must penelope include in her income

Answers: 1

You know the right answer?

Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the labe...

Questions

English, 27.06.2019 06:30

Mathematics, 27.06.2019 06:30

Biology, 27.06.2019 06:30

Mathematics, 27.06.2019 06:30

Mathematics, 27.06.2019 06:30

History, 27.06.2019 06:30

Chemistry, 27.06.2019 06:30

Business, 27.06.2019 06:30

English, 27.06.2019 06:30

Mathematics, 27.06.2019 06:30