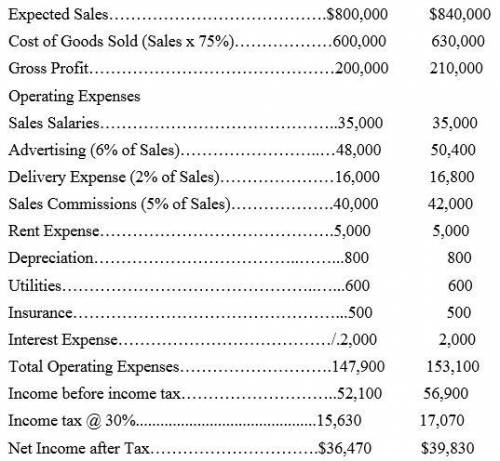

The budget committee of SUppar Company collects the following data for its San Miguel store in preparing budgeted income statements for May and June 2017.

1. sales for may are expected to be 800,000. sales in June and July are expected to be 5% higher than the preceeding month.

2. Cost of good sold is expecte to be 75% of sales

3. Company policy is to maintain ending merchandise inventory at 10% of the following months cost of goods sold.

4. Operating expenses are estimated to be as follows:

sales

35,000 per month

advertising 6% of monthly sales

delivery expense 2% of monthly sales

sales commission 5% of monthly sales

rent expense 5,000 per month

depreciation 800 per month

utilites 600 per month

insurance 500 per month

interest expense is 2,000 per month. Income taxes are estimated to be 30% of income before income taxes.

a) prepare the merchandise purchases budget for each month in columnar form.

b) prepare budgeted multiple-step income statements for each month in columnar form. Show in the statements the details of cost of good sold.

Answers: 3

Another question on Business

Business, 22.06.2019 01:10

Technology corp. is considering a $238,160 investment in a new marketing campaign that it anticipates will provide annual cash flows of $52,000 for the next five years. the firm has a 6% cost of capital. what should the analysis indicate to the firm's managers?

Answers: 2

Business, 22.06.2019 13:30

1. is the act of declaring a drivers license void and terminated when it is determined that the license was issued through error or fraud.

Answers: 2

Business, 22.06.2019 17:00

Vincent is interested in increasing his earning potential upon completing his internship at a major accounting firm. which option can immediately boost his career in the intended direction? b. complete a certification from a professional organization c. complete a new four-year undergraduate program in a related field d. complete a two-year associate degree in a related field e. complete an online course in accounting

Answers: 3

Business, 23.06.2019 02:30

Interview notes mike is 50 and made $36,000 in wages in 2017. he is single and pays all the cost of keeping up his home. mike's daughter, brittany, lived with mike all year. brittany's son, hayden, was born in november 2017. hayden lived in mike's home since birth. brittany is 25, single, and had $1,500 in wages in 2017. she is not disabled. mike provides more than half of the support for both brittany and hayden. mike, brittany, and hayden are all u.s. citizens with valid social security numbers. 4. who can mike claim as a qualifying child(ren) for the earned income credit?

Answers: 1

You know the right answer?

The budget committee of SUppar Company collects the following data for its San Miguel store in prepa...

Questions

Mathematics, 31.05.2021 18:30

Biology, 31.05.2021 18:30

Mathematics, 31.05.2021 18:30

Chemistry, 31.05.2021 18:30

Mathematics, 31.05.2021 18:30

Mathematics, 31.05.2021 18:30

English, 31.05.2021 18:30

Mathematics, 31.05.2021 18:30

Mathematics, 31.05.2021 18:30

Mathematics, 31.05.2021 18:30