Anne Cleves Company reported the following amounts in the stockholders’ equity section of its December 31, 2013, balance sheet. Preferred stock, 11%, $100 par (10,000 shares authorized, 2,280 shares issued) $228,000 Common stock, $5 par (127,550 shares authorized, 25,510 shares issued) 127,550 Additional paid-in capital 134,400 Retained earnings 478,700 Total $968,650 During 2014, Cleves took part in the following transactions concerning stockholders’ equity.

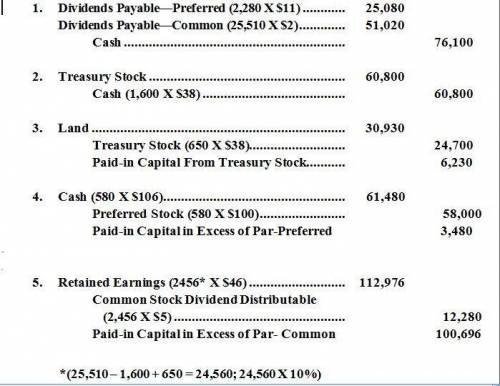

1. Paid the annual 2013 $11 per share dividend on preferred stock and a $2 per share dividend on common stock. These dividends had been declared on December 31, 2013.

2. Purchased 1,600 shares of its own outstanding common stock for $38 per share. Cleves uses the cost method.

3. Reissued 650 treasury shares for land valued at $30,930.

4. Issued 580 shares of preferred stock at $106 per share.

5. Declared a 10% stock dividend on the outstanding common stock when the stock is selling for $46 per share.

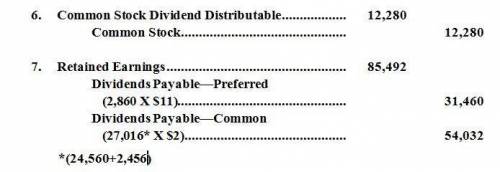

6. Issued the stock dividend.

7. Declared the annual 2014 $11 per share dividend on preferred stock and the $2 per share dividend on common stock. These dividends are payable in 2015.

(a) Prepare journal entries to record the transactions described above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

(b) Prepare the December 31, 2014, stockholders’ equity section. Assume 2014 net income was $334,600. (Enter account name only .Do not provide any descriptive information.)

Answers: 1

Another question on Business

Business, 22.06.2019 10:10

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 11:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 1

Business, 23.06.2019 00:10

Special order carson manufacturing, inc., sells a single product for $36 per unit. at an operating level of 8,000 units, variable costs are $18 per unit and fixed costs $10 per unit. carson has been offered a price of $20 per unit on a special order of 2,000 units by big mart discount stores, which would use its own brand name on the item. if carson accepts the order, material cost will be $3 less per unit than for regular production. however, special stamping equipment costing $4,000 would be needed to process the order; the equipment would then be discarded. assuming that volume remains within the relevant range, prepare an analysis of differential revenue and costs to determine whether carson should accept the special order. use a negative sign with answer to only indicate an income loss from special order; otherwise do not use negative signs with your answers.

Answers: 2

Business, 24.06.2019 02:00

How might we creat a sense of civility in both our social circles and our government?

Answers: 1

You know the right answer?

Anne Cleves Company reported the following amounts in the stockholders’ equity section of its Decemb...

Questions

Mathematics, 18.10.2020 14:01

Mathematics, 18.10.2020 14:01

Computers and Technology, 18.10.2020 14:01

English, 18.10.2020 14:01

History, 18.10.2020 14:01

English, 18.10.2020 14:01

Chemistry, 18.10.2020 14:01

English, 18.10.2020 14:01

Computers and Technology, 18.10.2020 14:01

Mathematics, 18.10.2020 14:01

English, 18.10.2020 14:01