Business, 06.03.2020 23:49 toricepeda82

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. Currently, the cost of producing each parka is estimated to be $55. This company is planning to produce approximately 2000 parkas in the next year. The quality manager of the company has estimated that, with the current situation, 15% of the parkas produced will be defective and only 60% of the defective parkas can be reworked. The rework cost is estimated to be $10.

The quality management department has suggested to upgrade the sewing machine to reduce the percentage of defective items. With this upgrade, the cost of producing each parka will be 60$ and the percentage of defective items will be 8%. The rework cost and the percentage of defective items that can be reworked do not change with this upgrade.

Calculate:

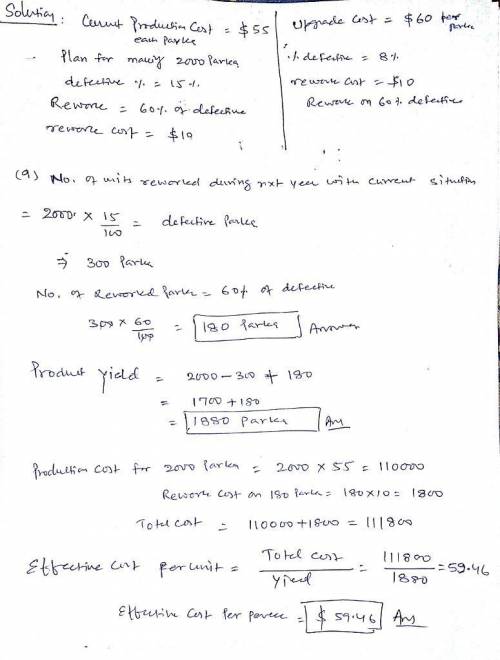

Number of units reworked during the next year, with the current situation:

Product yield during the next year, with the current situation:

Effective per unit production cost, with the current situation:

If the company wants the yield to be 2000, how many parkas they should plan to produce during the next year, with the current situation?

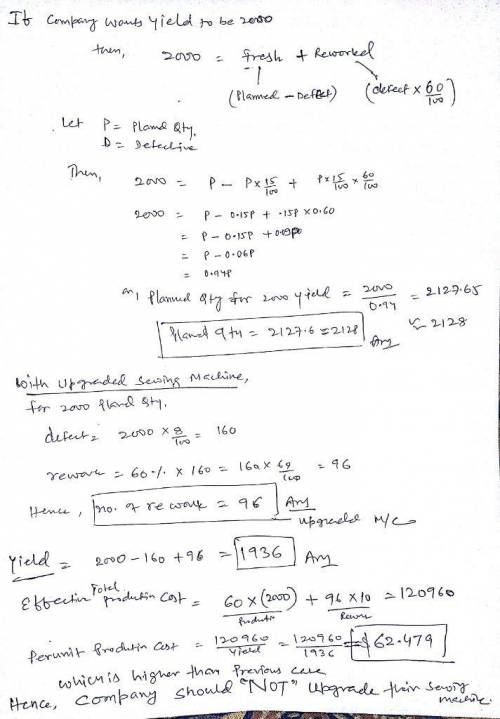

Number of units reworked annually with the upgraded sewing machine:

The Yield during the next year with the upgraded sewing machine:

Effective per unit production cost per with the upgraded sewing machine:

Should the company upgrade their sewing machine?

Yes

No

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

Ummit record company is negotiating with two banks for a $157,000 loan. fidelity bank requires a compensating balance of 24 percent, discounts the loan, and wants to be paid back in four quarterly payments. southwest bank requires a compensating balance of 12 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. the stated rate for both banks is 9 percent. compensating balances will be subtracted from the $157,000 in determining the available funds in part a. a-1. calculate the effective interest rate for fidelity bank and southwest bank. (do not round intermediate calculations. input your answers as a percent rounded to 2 decimal places.) a-2. which loan should summit accept? southwest bank fidelity bank b. recompute the effective cost of interest, assuming that summit ordinarily maintains $37,680 at each bank in deposits that will serve as compensating balances

Answers: 1

Business, 22.06.2019 19:40

An increase in the market price of men's haircuts, from $16 per haircut to $26 per haircut, initially causes a local barbershop to have its employees work overtime to increase the number of daily haircuts provided from 20 to 25. when the $26 market price remains unchanged for several weeks and all other things remain equal as well, the barbershop hires additional employees and provides 40 haircuts per day. what is the short-run price elasticity of supply? nothing (your answer should have two decimal places.) what is the long-run price elasticity of supply? nothing (your answer should have two decimal places.)

Answers: 1

Business, 22.06.2019 21:40

Rebel technology maintains its records using cash-basis accounting. during the year, the company received cash from customers, $43,000, and paid cash for salaries, $23,500. at the beginning of the year, customers owe rebel $1,000. by the end of the year, customers owe $6,600. at the beginning of the year, rebel owes salaries of $5,600. at the end of the year, rebel owes salaries of $3,300. determine cash-basis net income and accrual-basis net income for the year.

Answers: 2

Business, 23.06.2019 00:00

1. consider a two-firm industry. firm 1 (the incumbent) chooses a level of output qı. firm 2 (the potential entrant) observes qı and then chooses its level of output q2. the demand for the product is p 100 q, where q is the total output sold by the two firms which equals qi +q2. assume that the marginal cost of each firm is zero. a) find the subgame perfect equilibrium levels of qi and q2 keeping in mind that firm 1 chooses qi first and firm 2 observes qi and chooses its q2. find the profits of the two firms-n1 and t2- in the subgame perfect equilibrium. how do these numbers differ from the cournot equilibrium? b) for what level of qi would firm 2 be deterred from entering? would a rational firm 1 have an incentive to choose this level of qi? which entry condition does this market have: blockaded, deterred, or accommodated? now suppose that firm 2 has to incur a fixed cost of entry, f> 0. c) for what values of f will entry be blockaded? d) find out the entry deterring level of q, denoted by q1', a expression for firm l's profit, when entry is deterred, as a function of f. for what values of f would firm 1 use an entry deterring strategy?

Answers: 3

You know the right answer?

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. Currently, the cost...

Questions

Physics, 20.09.2019 03:00

Mathematics, 20.09.2019 03:00

Chemistry, 20.09.2019 03:00

English, 20.09.2019 03:00

Business, 20.09.2019 03:00

Mathematics, 20.09.2019 03:00

Mathematics, 20.09.2019 03:00

Mathematics, 20.09.2019 03:00

Geography, 20.09.2019 03:00

Mathematics, 20.09.2019 03:00

Mathematics, 20.09.2019 03:00