Business, 04.03.2020 22:57 yulaarmstrong

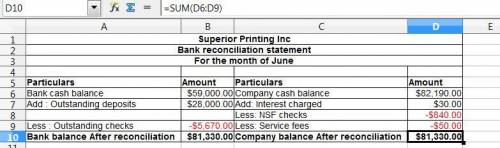

Superior Printing, Inc. has provided you with its bank statement and Cash T-account for the month of June. The Controller has asked you to prepare the Bank Reconciliation for the month of June.

BANK STATEMENT

Date Checks Deposits Other Balance

June 1 18,500

3 440 18,060

4 1200 16,860

8 500 16,360

10 1200 15,160

13 250 10,000 24,910

20 80 NSF 840 23,990

22 9800 35,000 49,190

26 350 48,840

27 4600 44,240

29 700 17000 60,540

30 920 Serv. Charge 50 59,570

30 600 Interest 30 59,000

Earned

Sheet # 2

Cash

June 1 Bal. 18,500

June 13 deposit 10,000 Check #100 440

June 22 deposit 35,000 Check #101 1200

June 29 deposit 17,000 Check #102 500

June 30 deposit 28,000 Check #103 1200

Check #104 250

Check #105 80

Check #106 9800

Check #107 350 . Check #108 4600

Check #109 770

Check #110 4900

Check #111 700

Check #112 920

Check #113 600

June 30 Bal. 82,190

Answers: 2

Another question on Business

Business, 21.06.2019 23:00

James has set the goal of achieving all "a"s during this year of school.which term best describes this goal

Answers: 2

Business, 21.06.2019 23:00

Which of the following statements is correct? large corporations are taxed more favorably than sole proprietorships. corporate stockholders are exposed to unlimited liability. due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of u.s. businesses (in terms of number of businesses) are organized as corporations. most businesses (by number and total dollar sales) are organized as partnerships or proprietorships because it is easier to set up and operate in one of these forms rather than as a corporation. however, if the business gets very large, it becomes advantageous to convert to a corporation, mainly because corporations have important tax advantages over proprietorships and partnerships. most business (measured by dollar sales) is conducted by corporations in spite of large corporations’ often less favorable tax treatment, due to legal considerations related to ownership transfers and limited liability.

Answers: 3

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 3

Business, 22.06.2019 22:00

In 2018, laureen is currently single. she paid $2,800 of qualified tuition and related expenses for each of her twin daughters sheri and meri to attend state university as freshmen ($2,800 each for a total of $5,600). sheri and meri qualify as laureen’s dependents. laureen also paid $1,900 for her son ryan’s (also laureen’s dependent) tuition and related expenses to attend his junior year at state university. finally, laureen paid $1,200 for herself to attend seminars at a community college to her improve her job skills.what is the maximum amount of education credits laureen can claim for these expenditures in each of the following alternative scenarios? a. laureen's agi is $45,000.b. laureen’s agi is $95,000.c. laureen’s agi is $45,000 and laureen paid $12,000 (not $1,900) for ryan to attend graduate school (i.e, his fifth year, not his junior year).

Answers: 2

You know the right answer?

Superior Printing, Inc. has provided you with its bank statement and Cash T-account for the month of...

Questions

Mathematics, 20.04.2021 14:00

World Languages, 20.04.2021 14:00

English, 20.04.2021 14:00

Mathematics, 20.04.2021 14:00

Social Studies, 20.04.2021 14:00

Computers and Technology, 20.04.2021 14:00

Physics, 20.04.2021 14:00

Advanced Placement (AP), 20.04.2021 14:00

Mathematics, 20.04.2021 14:00