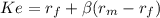

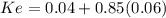

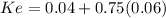

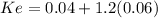

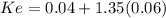

The risk-free rate of return is 4%, and the market return is 10%. The betas of Stocks A, B, C, D, and E are 0.85, 0.75, 1.20, 1.35, and 0.5 respectively. The expected rates of return for Stocks A, B, C, D, and E are 7%, 9%, 9.5%, 12.1%, and 14% respectively. Which of the above stocks would an investor be indifferent towards buying or selling?

Answers: 1

Another question on Business

Business, 22.06.2019 10:10

An investment offers a total return of 18 percent over the coming year. janice yellen thinks the total real return on this investment will be only 14 percent. what does janice believe the inflation rate will be over the next year?

Answers: 3

Business, 22.06.2019 12:30

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Business, 22.06.2019 18:50

Dominic is the founder of an innovative "impromptu catering" business that provides elegant, healthy party food and decorations on less than 24 hours' notice. the company has grown by over 150 percent in the past year. dominic credits some of the company's success to studying the strategies of prominent social entrepreneurs, such as wikipedia's jimmy wales. what can dominic do to exemplify the social entrepreneurship model?

Answers: 2

Business, 22.06.2019 20:40

If the ceo of a large, diversified, firm were filling out a fitness report on a division manager (i.e., "grading" the manager), which of the following situations would be likely to cause the manager to receive a better grade? in all cases, assume that other things are held constant.a. the division's basic earning power ratio is above the average of other firms in its industry.b. the division's total assets turnover ratio is below the average for other firms in its industry.c. the division's debt ratio is above the average for other firms in the industry.d. the division's inventory turnover is 6, whereas the average for its competitors is 8.e. the division's dso (days' sales outstanding) is 40, whereas the average for its competitors is 30.

Answers: 1

You know the right answer?

The risk-free rate of return is 4%, and the market return is 10%. The betas of Stocks A, B, C, D, an...

Questions

German, 24.12.2021 22:10

Law, 24.12.2021 22:10

Spanish, 24.12.2021 22:10

History, 24.12.2021 22:10

SAT, 24.12.2021 22:20

Mathematics, 24.12.2021 22:20

Chemistry, 24.12.2021 22:20

Mathematics, 24.12.2021 22:20