Business, 03.03.2020 06:09 kimlyn58p0wyn0

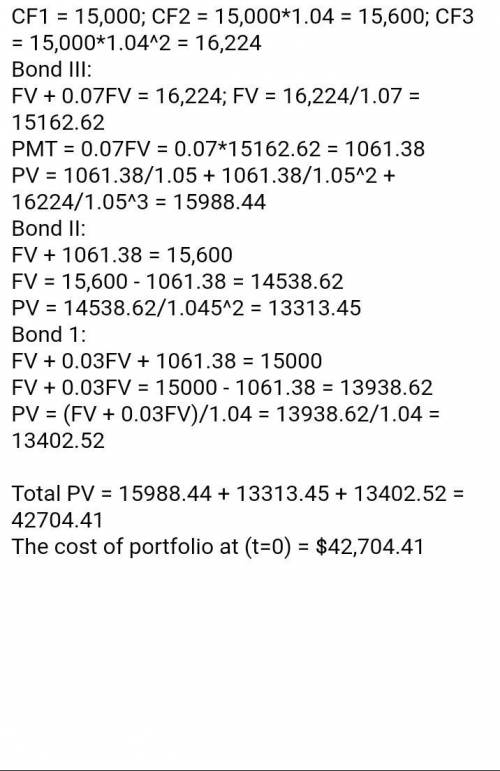

William plans to attend college for 3 years. His first day of college will be one year from today. He expects tuition to cost $15,000 in the first year. He also estimates that the college will increase his tuition by 4% each year for the next two years. William would like to exactly match these liabilities using the following assets: I. a one-year coupon bond with annual coupon of 3% and a yield to maturity of 4% II. a two-year zero coupon bond with a yield to maturity of 4.5% III. a three-year coupon bond with annual coupons of 7% and a yield to maturity of 5% What is the total cost of the asset portfolio that will exactly match the liabilities? a. 41,900 b. 42,300 c. 42,700 d. 43,100 e. 43,500

Answers: 1

Another question on Business

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

Business, 22.06.2019 22:50

Total marketing effort is a term used to describe the critical decision factors that affect demand: price, advertising, distribution, and product quality. define the variable x to represent total marketing effort. a typical model that is used to predict demand as a function of total marketing effort is based on the power function: d = axb suppose that a is a positive number. different model forms result from varying the constant b. sketch the graphs of this model for b = 0, b = 1, 0< b< 1, b< 0, and b> 1. (we encourage you to use excel to do this.) what does each model tell you about the relationship between demand and marketing effort? what assumptions are implied? are they reasonable? how would you go about selecting the appropriate model?

Answers: 1

Business, 23.06.2019 01:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 3

Business, 23.06.2019 02:50

Kandon enterprises, inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. both divisions are considered separate components as defined by generally accepted accounting principles. the horse division has been unprofitable, and on november 15, 2018, kandon adopted a formal plan to sell the division. the sale was completed on april 30, 2019. at december 31, 2018, the component was considered held for sale. on december 31, 2018, the company’s fiscal year-end, the book value of the assets of the horse division was $415,000. on that date, the fair value of the assets, less costs to sell, was $350,000. the before-tax loss from operations of the division for the year was $290,000. the company’s effective tax rate is 40%. the after-tax income from continuing operations for 2018 was $550,000. required: 1. prepare a partial income statement for 2018 beginning with income from continuing operations. ignore eps disclosures. 2. prepare a partial income statement for 2018 beginning with income from continuing operations. assuming that the estimated net fair value of the horse division’s assets was $700,000, instead of $350,000. ignore eps disclosures.

Answers: 2

You know the right answer?

William plans to attend college for 3 years. His first day of college will be one year from today. H...

Questions

Mathematics, 03.05.2020 13:51

Geography, 03.05.2020 13:51

Arts, 03.05.2020 13:51

Mathematics, 03.05.2020 13:51

Mathematics, 03.05.2020 13:51

Mathematics, 03.05.2020 13:51

French, 03.05.2020 13:51

English, 03.05.2020 13:51

Mathematics, 03.05.2020 13:51

Mathematics, 03.05.2020 13:51

Mathematics, 03.05.2020 13:51