Business, 03.03.2020 04:52 valenciafaithtorres

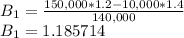

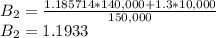

You hold a diversified portfolio consisting of a $10,000 investment in each of 15 different common stocks (i. e., your total investment is $150,000). The portfolio beta is equal to 1.2 . You have decided to sell one of your stocks which has a beta equal to 1.4 for $10,000. You plan to use the proceeds to purchase another stock which has a beta equal to 1.3 . What will be the beta of the new portfolio? Show your answer to 2 decimal places.

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Iam trying to get more members on my blog. how do i do that?

Answers: 2

Business, 22.06.2019 05:10

1. descriptive statistics quickly describe large amounts of data can predict future stock returns with surprising accuracy statisticians understand non-numeric information, like colors refer mainly to patterns that can be found in data 2. a 15% return on a stock means that 15% of the original purchase price of the stock returns to the seller at the end of the year 15% of the people who purchased the stock will see a return the stock is worth 15% more at the end of the year than at the beginning the stock has lost 15% of its value since it was originally sold 3. a stock purchased on january 1 cost $4.35 per share. the same stock, sold on december 31 of the same year, brought in $4.75 per share. what was the approximate return on this stock? 0.09% 109% 1.09% 9% 4. a stock sells for $6.99 on december 31, providing the seller with a 6% annual return. what was the price of the stock at the beginning of the year? $6.59 $1.16 $7.42 $5.84

Answers: 3

Business, 22.06.2019 10:30

On july 1, oura corp. made a sale of $ 450,000 to stratus, inc. on account. terms of the sale were 2/10, n/30. stratus makes payment on july 9. oura uses the net method when accounting for sales discounts. ignore cost of goods sold and the reduction of inventory. a. prepare all oura's journal entries. b. what net sales does oura report?

Answers: 2

You know the right answer?

You hold a diversified portfolio consisting of a $10,000 investment in each of 15 different common s...

Questions

Mathematics, 08.05.2021 06:40

Mathematics, 08.05.2021 06:40

Mathematics, 08.05.2021 06:40

Mathematics, 08.05.2021 06:40

Mathematics, 08.05.2021 06:40

History, 08.05.2021 06:40

Mathematics, 08.05.2021 06:40

History, 08.05.2021 06:40

Mathematics, 08.05.2021 06:40

Mathematics, 08.05.2021 06:40

History, 08.05.2021 06:40