Business, 28.02.2020 03:56 kyandrewilliams1

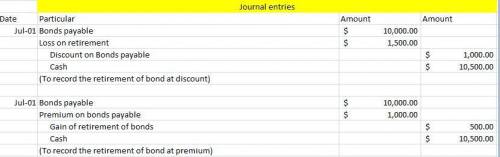

Tyrell Company issued callable bonds with a par value of $10,000. The call option requires Tyrell to pay a call premium of $500 plus par (or a total of $10,500) to bondholders to retire the bonds. On July 1, Tyrell exercises the call option. The call option is exercised after the semiannual interest is paid the day before on June 30. Record the entry to retire the bonds under each separate situation.

(1) The bonds have a carrying value of $9,000.

(2) The bonds have a carrying value of $11,000.

Answers: 3

Another question on Business

Business, 21.06.2019 20:50

Suppose the price of frozen yogurt, a substitute for ice cream, increases. what happens to equilibrium price and quantity of ice cream? a. the price and quantity of ice cream both increase b. the price and quantity of ice cream both decrease c. the price of ice cream increases and the quantity decreases d. the price of ice cream decreases and the quantity increases

Answers: 3

Business, 23.06.2019 12:30

"richard wants to know how his company handles late lunches but does not want to ask anyone. instead, he watches others take late lunches and observes the manager's reaction. richard is"

Answers: 3

Business, 23.06.2019 18:00

In financial language, a "quarter" is one quarter of a year, or three months. your annual sales are $123,000. the sales are spread evenly over four quarters except that sales in the last quarter are double any other quarter because of the holidays. what are your sales in the first quarter of the year?

Answers: 3

You know the right answer?

Tyrell Company issued callable bonds with a par value of $10,000. The call option requires Tyrell to...

Questions

History, 27.09.2019 05:30

Biology, 27.09.2019 05:30

Mathematics, 27.09.2019 05:30

Chemistry, 27.09.2019 05:30