Business, 28.02.2020 03:54 abigailweeks10

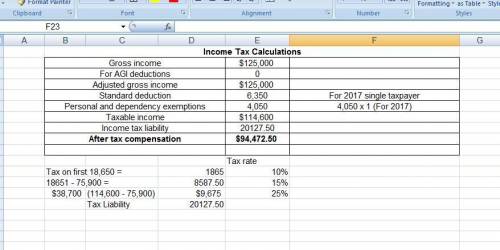

Rick, who is single, has been offered a position as a city landscape consultant. the position pays $125,000 in cash wages. assume Rick files single and is entitled to one personal exemption. Rick deducts the standard deduction instead of itemized deductions. (use the tax rate schedules.)

a. what is the amount of Rocks after-tax compensation (ignore payroll taxes )?( do not round intermediate calculations. round income tax liability and After-tax compensation to 2 decimal places. enter deductions as negative amounts)

1. Gross income

2. for AGI deductions

3. adjusted gross income

4. standard deduction

5. personal and dependency exemptions

6. taxable income

7. income tax liability

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

He set of companies a product goes through on the way to the consumer is called the a. economic utility b. cottage industry c. market saturation d. distribution chain

Answers: 3

Business, 21.06.2019 22:00

If a bond is issued at a premium the effective interest rate is most likely

Answers: 2

Business, 22.06.2019 11:00

Zoe would like to be able to save for night courses at the local college. which of these would be a good way for zoe to make more money available for savings without dramatically changing her budget? economía

Answers: 2

Business, 22.06.2019 12:00

Identify at least 3 body language messages that project a positive attitude

Answers: 2

You know the right answer?

Rick, who is single, has been offered a position as a city landscape consultant. the position pays $...

Questions

Mathematics, 26.06.2019 13:30

Biology, 26.06.2019 13:30

Mathematics, 26.06.2019 13:30

Biology, 26.06.2019 13:30

History, 26.06.2019 13:30

Biology, 26.06.2019 13:30

Physics, 26.06.2019 13:30

History, 26.06.2019 13:30

Biology, 26.06.2019 13:30

Mathematics, 26.06.2019 13:30