Business, 28.02.2020 03:54 mariah10455

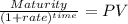

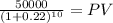

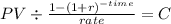

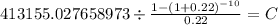

In an effort to reduce costs, Pontic Manufacturing Corporation is considering an investment in equipment that will reduce defects This equipment will cost $420,000, will have an estimated useful life of 10 years, and will have an estimated salvage value of $50,000 at the end of 10 years. The company's discount rate is 22%. what amount of cost savings will this equipment have to generate per year in each of the 10 years in order for it to be an acceptable project? (Ignore income taxes.) Click here to view Exhibit 13B-1 and Exhibit 138-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice a. $50,690 or more b. 105,315 or more c. $94,316 or more d. $41,315 or more

Answers: 2

Another question on Business

Business, 21.06.2019 13:00

Fern corporation manufacturers a single product that has a selling price of $20.00 per unit. fixed expenses total $48,000 per year, and the company must sell 6,000 units to break even. if the company has a target profit of $14,000, sales in units must be:

Answers: 1

Business, 21.06.2019 19:40

Which of the following is false regarding the links between jit and quality? a. jit increases the cost of obtaining good quality. b. as quality improves, fewer inventory buffers are needed; in turn, jit performs better. c. jit reduces the number of potential sources of error by shrinking queues and lead times. d. inventory hides bad quality; jit immediately exposes it. e. if consistent quality exists, jit allows firms to reduce all costs associated with inventory.

Answers: 3

Business, 21.06.2019 20:20

Miller mfg. is analyzing a proposed project. the company expects to sell 8,000 units, plus or minus 2 percent. the expected variable cost per unit is $11 and the expected fixed costs are $287,000. the fixed and variable cost estimates are considered accurate within a plus or minus 5 percent range. the depreciation expense is $68,000. the tax rate is 32 percent. the sales price is estimated at $64 a unit, plus or minus 3 percent. what is the earnings before interest and taxes under the base case scenario?

Answers: 1

Business, 22.06.2019 02:20

Archangel manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. the production details for the year are given below. calculate the manufacturing overhead allocation rate for the year based on the above data. (round your final answer to two decimal places.) a) 42.42% b) 257.14% c) 235.71% d) 1, 206.90% archangel production details.

Answers: 3

You know the right answer?

In an effort to reduce costs, Pontic Manufacturing Corporation is considering an investment in equip...

Questions

Computers and Technology, 18.11.2020 14:00

Mathematics, 18.11.2020 14:00

English, 18.11.2020 14:00

Mathematics, 18.11.2020 14:00

Social Studies, 18.11.2020 14:00

Physics, 18.11.2020 14:00

Mathematics, 18.11.2020 14:00

Mathematics, 18.11.2020 14:00

Mathematics, 18.11.2020 14:00

Mathematics, 18.11.2020 14:00