Business, 28.02.2020 01:48 catuchaljean1623

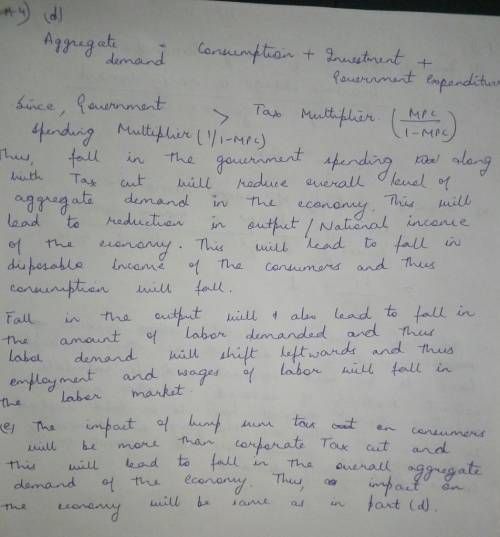

Consider an economy with one representative consumer, one representative firm and the government. Suppose that the consumer has one unit of labor and she supplies her labor inelastically. That means she works a fixed amount N, no matter what the wage is. The consumer's budget constraint is c = WN + Tt, and it is firm's profit. To simplify the question, assume the firm uses only labor input with the production function y = 2N1-4. The firm must pay a proportional tax on its revenue at tax rate Ty. The government funds its spending g from the corporate tax. a. Set up and solve for the firm's labor demand. Use diagram to determine the wage and employment in equilibrium. Now suppose that the government reduces the corporate tax. The corporate tax rate becomes t2 <11. b. What happens to the firm's labor demand? On the same diagram from (a), show the new labor market equilibrium. c. What happens to the consumption and output in equilibrium? Consider the fact that to fund the tax cut, the government must either reduce spending or increase some other tax. d. Suppose that the government reduces government spending by the amount needed to fund the tax cut. Now what happens on net to wages, employment, consumption and output?

Answers: 1

Another question on Business

Business, 21.06.2019 20:20

Atoy manufacturer makes its own wind-up motors, which are then put into its toys. while the toy manufacturing process is continuous, the motors are intermittent flow. data on the manufacture of the motors appears below.annual demand (d) = 50,000 units daily subassembly production rate = 1,000setup cost (s) = $85 per batch daily subassembly usage rate = 200carrying cost = $.20 per unit per year(a) to minimize cost, how large should each batch of subassemblies be? (b) approximately how many days are required to produce a batch? (c) how long is a complete cycle? (d) what is the average inventory for this problem? (e) what is the total annual inventory cost (holding plus setup) of the optimal behavior in this problem?

Answers: 2

Business, 22.06.2019 04:30

Jennifer purchased a house in a brand new development in the outskirts of town. when her house was built, the nearest fire department was nearly 20 miles away. as her neighborhood developed, the density of the community called for a new fire department 1.5 miles away. what effect will the new fire station have on her homeowners insurance premium? a. a new fire department will be more demanding on local taxes. her annual premium will go up. b. the location of a fire department has no bearing on the value of her house. her annual premium will stay the same. c. the new fire department will reduce the risk of financial loss in her home. her annual premium should decrease. d. with a fire department so close (less than 5 miles), financial risk on jennifer’s home practically disappears. she will not need to pay insurance anymore.

Answers: 1

Business, 22.06.2019 12:10

Which of the following is not part of the mission statement of the department of homeland security? lead the unified national effort to secure america protect against and respond to threats and hazards to the nation ensure safe and secure borders coordinate intelligence operations against terrorists in other countries

Answers: 1

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

You know the right answer?

Consider an economy with one representative consumer, one representative firm and the government. Su...

Questions

Mathematics, 17.01.2020 04:31

History, 17.01.2020 04:31

English, 17.01.2020 04:31

Mathematics, 17.01.2020 04:31

Mathematics, 17.01.2020 04:31

Mathematics, 17.01.2020 04:31

Mathematics, 17.01.2020 04:31