Business, 27.02.2020 17:44 Kingmoney959

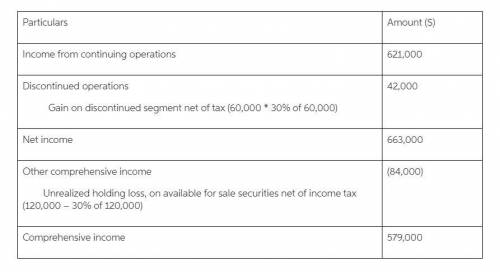

Dos Amugus Company has income from continuing operations of $621,000 (after tax) for the year ended December 31, 2017. It also has the following items (before considering income taxes): (1) An unrealized loss of $120,000 available-for-sale-securities. (2) A gain of $60,000 on the discontinuance of a major component. (3) A cumulative effect of a change in accounting principle that resulted in an increase in prior years' depreciation of $50,000. Assume all items are subject to income taxes at a 30% tax rate. Prepare a statement of comprehensive income, beginning with income from continuing operations

Answers: 1

Another question on Business

Business, 22.06.2019 19:00

When making broccoli cream soup, the broccoli and aromatics should be a. burned. b. simmered. c. puréed. d. sweated.

Answers: 2

Business, 22.06.2019 19:50

At the beginning of 2014, winston corporation issued 10% bonds with a face value of $2,000,000. these bonds mature in five years, and interest is paid semiannually on june 30 and december 31. the bonds were sold for $1,852,800 to yield 12%. winston uses a calendar-year reporting period. using the effective-interest method of amortization, what amount of interest expense should be reported for 2014? (round your answer to the nearest dollar.)

Answers: 2

Business, 23.06.2019 00:30

Bruno's pizza restaurant makes full payment of $8,300 on an account payable to stella's cheese co. stella's would record this transaction with a

Answers: 3

Business, 23.06.2019 03:20

You have just made your first $5,500 contribution to your retirement account. assume you earn a return of 10 percent per year and make no additional contributions. a. what will your account be worth when you retire in 45 years? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. what if you wait 10 years before contributing?

Answers: 1

You know the right answer?

Dos Amugus Company has income from continuing operations of $621,000 (after tax) for the year ended...

Questions

Mathematics, 06.10.2019 22:30

Mathematics, 06.10.2019 22:30

History, 06.10.2019 22:30

Mathematics, 06.10.2019 22:30

Mathematics, 06.10.2019 22:30

Biology, 06.10.2019 22:30

Mathematics, 06.10.2019 22:30

Mathematics, 06.10.2019 22:30

History, 06.10.2019 22:30

Mathematics, 06.10.2019 22:30

Mathematics, 06.10.2019 22:30

Computers and Technology, 06.10.2019 22:30