Business, 27.02.2020 17:19 jessbri5150

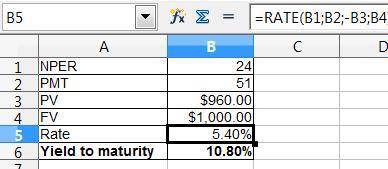

Parkway Void Co. issued 14-year bonds two years ago at a coupon rate of 10.2 percent. The bonds make semiannual payments. If these bonds currently sell for 96 percent of par value, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 3

Another question on Business

Business, 21.06.2019 14:30

As he explores his options, sergio notices that some opportunities appear to be riskier than others. when considering various opportunities, sergio should keep in mind that:

Answers: 1

Business, 21.06.2019 22:10

You have just received notification that you have won the $2.0 million first prize in the centennial lottery. however, the prize will be awarded on your 100th birthday (assuming you're around to collect), 66 years from now. what is the present value of your windfall if the appropriate discount rate is 8 percent?

Answers: 1

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 18:00

What would not cause duff beer’s production possibilities curve to expand in the short run? a. improved manufacturing technology b. additional resources c. increased demand

Answers: 1

You know the right answer?

Parkway Void Co. issued 14-year bonds two years ago at a coupon rate of 10.2 percent. The bonds make...

Questions

English, 04.07.2019 01:20

English, 04.07.2019 01:20

Computers and Technology, 04.07.2019 01:20

Computers and Technology, 04.07.2019 01:20

History, 04.07.2019 01:30

Mathematics, 04.07.2019 01:30

Social Studies, 04.07.2019 01:30

Health, 04.07.2019 01:30

Mathematics, 04.07.2019 01:30

Mathematics, 04.07.2019 01:30

Biology, 04.07.2019 01:30

Mathematics, 04.07.2019 01:30