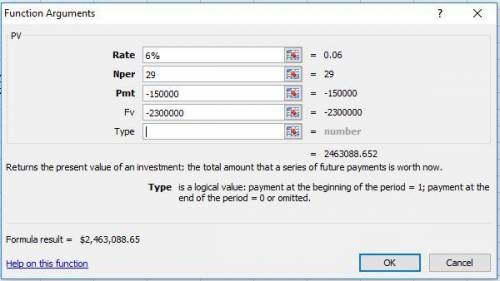

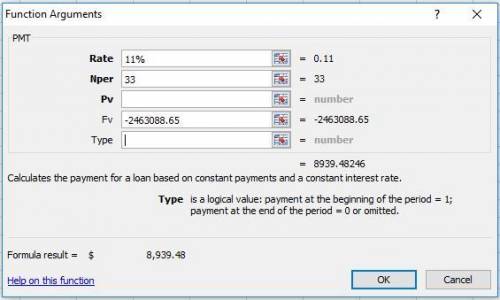

You plan to retire 33 years from now. You expect that you will live 29 years after retiring. You want to have enough money upon reaching retirement age to withdraw $150,000 from the account at the beginning of each year you expect to live, and yet still have $2,300,000 left in the account at the time of your expected death (62 years from now). You plan to accumulate the retirement fund by making equal annual deposits at the end of each year for the next 33 years. You expect that you will be able to earn 11% per year on your deposits. However, you only expect to earn 6% per year on your investment after you retire since you will choose to place the money in less risky investments. What equal annual deposits must you make each year to reach your retirement goal?

Answers: 3

Another question on Business

Business, 22.06.2019 08:30

Hi inr 2002 class! i just uploaded a detailed study guide for this class. you can check-out a free preview by following the link below feel free to reach-out to me if you need a study buddy or have any questions. goodluck!

Answers: 1

Business, 22.06.2019 09:00

According to this excerpt, a key part of our national security strategy is

Answers: 2

Business, 22.06.2019 10:10

An investment offers a total return of 18 percent over the coming year. janice yellen thinks the total real return on this investment will be only 14 percent. what does janice believe the inflation rate will be over the next year?

Answers: 3

Business, 22.06.2019 20:10

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

You know the right answer?

You plan to retire 33 years from now. You expect that you will live 29 years after retiring. You wan...

Questions

Mathematics, 19.04.2020 02:23

Mathematics, 19.04.2020 02:23

English, 19.04.2020 02:23

History, 19.04.2020 02:23

Mathematics, 19.04.2020 02:23

History, 19.04.2020 02:23

History, 19.04.2020 02:23

Biology, 19.04.2020 02:24

Mathematics, 19.04.2020 02:24

Mathematics, 19.04.2020 02:24