Business, 26.02.2020 23:53 RachelCamel

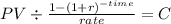

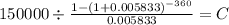

A 3/1 ARM is made for $150,000 at 7% with a 30 year maturity. Assuming that fixed payments are to be made monthly for three years and that the loan is fully amortizing, what will be the monthly payments?

Answers: 3

Another question on Business

Business, 21.06.2019 20:00

When an interest-bearing note comes due and is uncollectible, the journal entry includes debiting

Answers: 3

Business, 22.06.2019 04:50

Problem 9-5. net present value and taxes [lo 1, 2] penguin productions is evaluating a film project. the president of penguin estimates that the film will cost $20,000,000 to produce. in its first year, the film is expected to generate $16,500,000 in net revenue, after which the film will be released to video. video is expected to generate $10,000,000 in net revenue in its first year, $2,500,000 in its second year, and $1,000,000 in its third year. for tax purposes, amortization of the cost of the film will be $12,000,000 in year 1 and $8,000,000 in year 2. the company’s tax rate is 35 percent, and the company requires a 12 percent rate of return on its films. required what is the net present value of the film project? to simplify, assume that all outlays to produce the film occur at time 0. should the company produce the film?

Answers: 2

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

You know the right answer?

A 3/1 ARM is made for $150,000 at 7% with a 30 year maturity. Assuming that fixed payments are to be...

Questions

Mathematics, 27.09.2020 21:01

Mathematics, 27.09.2020 21:01

History, 27.09.2020 21:01

Mathematics, 27.09.2020 21:01

Advanced Placement (AP), 27.09.2020 21:01

Mathematics, 27.09.2020 21:01

English, 27.09.2020 21:01

Advanced Placement (AP), 27.09.2020 21:01

English, 27.09.2020 21:01