Business, 26.02.2020 22:04 kjhgfcvb5761

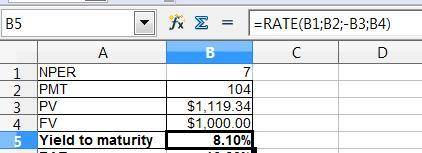

The Petit Chef Co. has 10.4 percent coupon bonds on the market with seven years left to maturity. The bonds make annual payments and have a par value of $1,000. If the bonds currently sell for $1,119.34, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 2

Another question on Business

Business, 21.06.2019 22:10

Fess receives wages totaling $74,500 and has net earnings from self-employment amounting to $71,300. in determining her taxable self-employment income for the oasdi tax, how much of her net self-employment earnings must fess count? a. $74,500 b. $71,300 c. $53,900 d. $127,200 e. none of the above.

Answers: 3

Business, 22.06.2019 03:00

In the supply-and-demand schedule shown above, at the lowest price of $50, producers supply music players and consumers demand music players.

Answers: 2

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 15:00

Because gloria's immediate concern was the perceived gender discrimination, she would be more concerned about than intent, resultsresults, intentstatistics, trendsrace,gendergender,race

Answers: 2

You know the right answer?

The Petit Chef Co. has 10.4 percent coupon bonds on the market with seven years left to maturity. Th...

Questions

Chemistry, 28.07.2020 05:01

Mathematics, 28.07.2020 05:01

Mathematics, 28.07.2020 05:01

Geography, 28.07.2020 05:01

Mathematics, 28.07.2020 05:01

Mathematics, 28.07.2020 05:01

Mathematics, 28.07.2020 05:01

Mathematics, 28.07.2020 05:01