Business, 26.02.2020 05:54 Juniper816

SAB Technology Corporation increased its sales from $400,000 in 2012 to $500,000 in year 2013 as is shown in the firm’s income statements presented below. Jenny Sands, chief executive officer (CEO) and founder of the firm expressed concern that the cash account and the firm’s marketable securities declined substantially between 2012 and 2013. SAB's complete balance sheets are also shown below. Ms. Sands is seeking your assistance in the preparation of a statement of cash flows for SAB Financial Statements 1 Income statement (in $ Thousands) 2013 2012 2 3 Net sales 500.00 400.00 4 Less: cogs 300.00 240.00 5 Gross profit 200.00 160.00 6 Less: operating exp 46.00 46.00 7 Less: Depr 30.00 25.00 8 EBIT 124.00 89.00 9 Less: Interest 38.50 33.50 10 Income before tax 85.50 55.50 11 Less: Income taxes 30.00 20.00 12 Net income 55.50 35.50 13 14 Cash dividend 20.00 17.00 15 Addition to retained earnings 35.50 18.50 16 17 18 Balance sheet (in $ Thousands) 2013 2012 19 20 Cash 16.00 39.00 21 Account receivable 80.00 50.00 22 Inventories 204.00 151.00 23 Current asset 300.00 240.00 24 Gross fixed asset 290.00 200.00 25 less: accumuled depr 125.00 95.00 26 Net fixed asset 165.00 105.00 27 Total assets 465.00 345.00 28 29 Account payable 45.00 30.00 30 Accrued liabilities 23.00 10.00 31 Short-term notes 27.00 20.00 32 Total current liabilities 95.00 60.00 33 Long-term debt 20.00 15.00 34 Total liabilities 115.00 75.00 35 Common stock 129.50 85.00 36 Retained earnings 220.50 185.00 37 Owners' equity 350.00 270.00 38 Total liabilities and equity 465.00 345.00

1) Study the excel template _efu_homework2_excel. xlsxPreview the document

2) Cash flow analysis for year 2013 cash flows from operating activities = ?? cash flow from investment activities = ?? cash flow from financing activities = ?? net cash flow = ?? cash at the end of period = ??

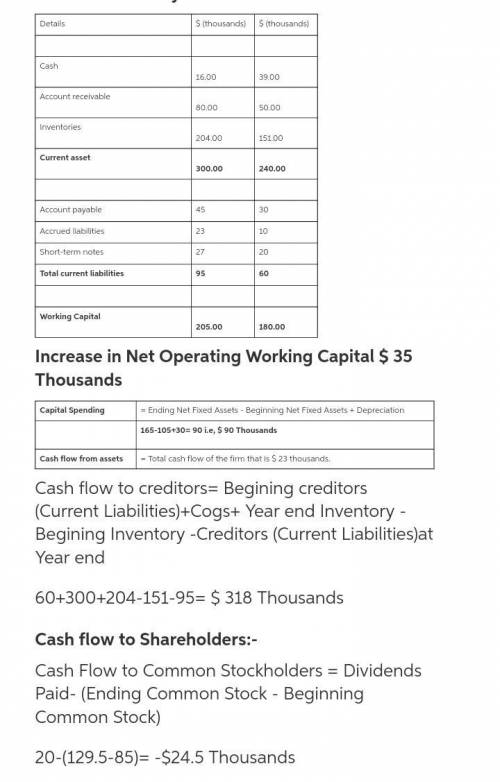

3) Cash flow identity for year 2013 Operating cash flow = EBIT + D&A - Tax = ?? Change in Net Operating Working Capital = Change in NOWC = ?? Net Capital Spending = ?? Cash flow from assets = ?? Cash flow to creditors = ?? Cash flow to Shareholders = ??

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Juwana was turned down for a car loan by a local credit union she thought her credit was good what should her first step be

Answers: 1

Business, 22.06.2019 06:00

If you miss two payments on a credit card what is generally the penalty

Answers: 1

Business, 22.06.2019 07:50

Connors academy reported inventory in the 2017 year-end balance sheet, using the fifo method, as $154,000. in 2018, the company decided to change its inventory method to lifo. if the company had used the lifo method in 2017, the company estimates that ending inventory would have been in the range $130,000-$135,000. what adjustment would connors make for this change in inventory method?

Answers: 1

Business, 22.06.2019 12:00

In mexico, many garment or sewing shops found they could entice many young people to work for them if they offered clean, air conditioned work areas with high-quality locker rooms to clean up in after the work day. typically, traditional garment shops had to offer to get workers to apply for the hard, repetitive, and somewhat dangerous work. a. benchmark competitive wages b.compensating differentials c. monopoly wages d. wages based on human capital development of each employee

Answers: 3

You know the right answer?

SAB Technology Corporation increased its sales from $400,000 in 2012 to $500,000 in year 2013 as is...

Questions

Mathematics, 08.07.2020 14:01

Mathematics, 08.07.2020 14:01

Mathematics, 08.07.2020 14:01

Mathematics, 08.07.2020 14:01

Mathematics, 08.07.2020 14:01

Biology, 08.07.2020 14:01

Chemistry, 08.07.2020 14:01

Physics, 08.07.2020 14:01

History, 08.07.2020 14:01