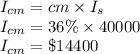

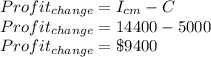

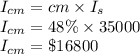

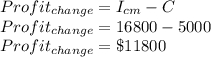

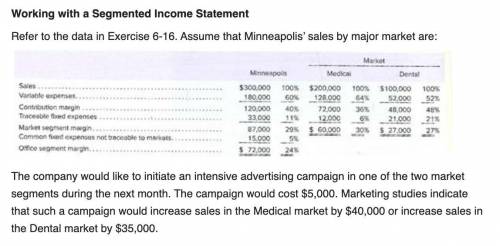

1. How much would the company’s profits increase (decrease) if it implemented the advertising campaign in the Medical Market?2. How much would the company’s profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign?4. In Exercise 6–16, Minneapolis shows $48,000 in traceable fixed expenses. What happened to the $48,000 in this exercise?

Answers: 1

Another question on Business

Business, 23.06.2019 13:10

Use the drop-down menus to complete the statements about credit reports and scores. a credit report summarizes a person’s . a credit score is a measure of a person’s as a borrower. is a factor that contributes to a person’s credit score.

Answers: 2

Business, 23.06.2019 13:20

Use the drop-down menus to complete each sentence. according to the theories of friedrich august von hayek, the economy may be too complicated to think in terms . hayek believed was dangerous and could lead to severe inflation. milton friedman supported changes policy to influence economic growth.answers : aggregates; expansionary policy; monetary

Answers: 3

Business, 23.06.2019 14:20

Suppose a mutual fund qualifies as having moderate risk if the standard deviation of its monthly rate of return is less than 3%. a mutual-fund rating agency randomly selects 27 months and determines the rate of return for a certain fund. the standard deviation of the rate of return is computed to be 2.19%. is there sufficient evidence to conclude that the fund has moderate risk at the alpha equals 0.05 level of significance? a normal probability plot indicates that the monthly rates of return are normally distributed.

Answers: 2

Business, 23.06.2019 15:30

Bill is 31 years old, married, and lived with his spouse michelle from january 2018 to september 2018. bill paid all the cost of keeping up his home. he indicated that he is not legally separated and he and michelle agreed they will not a file a joint return. bill has an 8-year-old son, daniel, who qualifies as bill's dependent. bill worked as a clerk and his wages are $20,000 for 2018. his income tax before credits is $500. in 2018, he took a computer class at the local university to improve his job skills. bill has a receipt showing he paid $1,200 for tuition. he paid for all his educational expenses and did not receive any assistance or reimbursement. bill does not have enough deductions to itemize. bill, michelle, and daniel are u.s. citizens with valid social security numbers. 8. bill does not qualify to claim which of the following: a. head of household b. education benefit c. earned income credit d. all of the above

Answers: 3

You know the right answer?

1. How much would the company’s profits increase (decrease) if it implemented the advertising campai...

Questions

Mathematics, 16.11.2020 23:10

Mathematics, 16.11.2020 23:10

Mathematics, 16.11.2020 23:10

Mathematics, 16.11.2020 23:10

World Languages, 16.11.2020 23:10

Mathematics, 16.11.2020 23:10