Business, 22.02.2020 03:07 meganaandrewsat

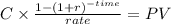

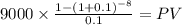

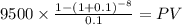

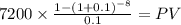

One of three machines must be purchased to meet an immediate need in company ACME. ACME uses a MARR of 10% in its analysis. Machine A costs 45,000 to install and will cost 9000 each year to run. Machine B has an operating cost of 9500 annually and costs 32,000 to install. Machine C can be bought for 51,000 and costs 7200 to run each year. All machines are expected to run for 8 years but only Machine C has a salvage value of 4,000. Using incremental ROR methods, identify the best economic choice.

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

1) u.s. real gdp is substantially higher today than it was 60 years ago. what does this tell us, and what does it not tell us, about the well-being of u.s. residents? what are the limitations of the gdp as a measure of economic well-being? given the limitations, why is gdp usually regarded as the best single measure of a society’s economic well-being? 2) what is an intermediate good? how does an intermediate good differ from a final good? explain why it is the case that the value of intermediate goods produced and sold during the year is not included directly as part of gdp, but the value of intermediate goods produced and not sold is included directly as part of gdp.

Answers: 2

Business, 22.06.2019 05:50

Which is one solution to levy the complexity of the global matrix strategy with added customer-focused dimensions?

Answers: 3

Business, 22.06.2019 11:30

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill. student a incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

You know the right answer?

One of three machines must be purchased to meet an immediate need in company ACME. ACME uses a MARR...

Questions

Biology, 06.11.2020 02:50

History, 06.11.2020 02:50

Arts, 06.11.2020 02:50

Mathematics, 06.11.2020 02:50

Mathematics, 06.11.2020 02:50

Social Studies, 06.11.2020 03:00

Mathematics, 06.11.2020 03:00

Mathematics, 06.11.2020 03:00