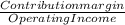

3-30 Operating leverage. Cover Rugs is holding a 2-week carpet sale at Josh’s Club, a local warehouse store. Cover Rugs plans to sell carpets for $950 each. The company will purchase the carpets from a local distributor for $760 each, with the privilege of returning any unsold units for a full refund. Josh’s Club has offered Cover Rugs two payment alternatives for the use of space. · Option 1: A fixed payment of $7,410 for the sale period · Option 2: 10% of total revenues earned during the sale period Assume Cover Rugs will incur no other costs. Required: 1. Calculate the breakeven point in units for (a) Option 1 and (b) Option 2. 2. At what level of revenues will Cover Rugs earn the same operating income under either option? a. For what range of unit sales will Cover Rugs prefer Option 1? b. For what range of unit sales will Cover Rugs prefer Option 2? 3. Calculate the degree of operating leverage at sales of 65 units for the two rental options. 4. Briefly explain and interpret your answer to requirement 3.

Answers: 2

Another question on Business

Business, 21.06.2019 16:30

The movement of an economy from one condition to another and back again

Answers: 2

Business, 21.06.2019 20:30

What is the most important type of decision that the financial manager makes?

Answers: 2

Business, 22.06.2019 01:00

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

Business, 22.06.2019 18:30

Jason started last week with $900 in his checking account. during the week, he wrote the checks below. at the end of the week, jason received a paycheck for $534.59. he recorded all of these transactions in his check register. trans typ./ check no. date description of transaction payment/ debit deposit/ credit (+) balance 900 00 241 12/4 miller's food market 53.21 53 21 groceries 846 79 242 12/7 frank's auto parts 24.05 24 05 oil and filter 822 74 243 12/8 mike's barber shop 15.00 15 00 haircut 807 74 deposit 12/9 paycheck 534.59 534 59 1,342 33 evaluate jason's check register. a. jason did a good job; everything is correct. b. the final balance is wrong; jason did not add everything correctly. c. jason should have written debit instead of deposit for the transaction type. d. jason entered the amount for his paycheck in the wrong column.

Answers: 3

You know the right answer?

3-30 Operating leverage. Cover Rugs is holding a 2-week carpet sale at Josh’s Club, a local warehous...

Questions

Mathematics, 03.06.2020 03:59

Biology, 03.06.2020 03:59

Chemistry, 03.06.2020 03:59

History, 03.06.2020 03:59

Biology, 03.06.2020 03:59

Mathematics, 03.06.2020 03:59

Computers and Technology, 03.06.2020 03:59