Business, 22.02.2020 02:07 venancialee8805

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2014, and mature January 1, 2019, with interest payable December 31 of each year. Aumont Company allocates interest and unamortized discount or premium on the effective-interest basis.

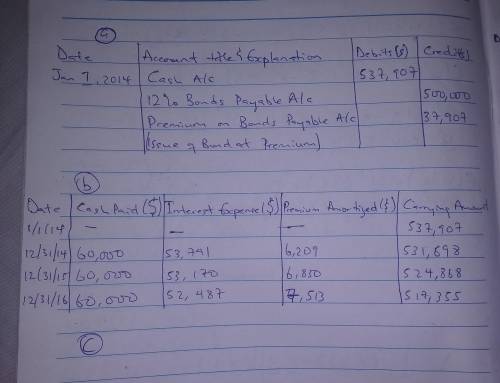

(a) Prepare the journal entry at the date of the bond issuance. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

January 1, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(b) Prepare a schedule of interest expense and bond amortization for 2014?2016. (Round answers to 0 decimal places, e. g. 38,548.)

Schedule of Interest Expense and Bond Premium Amortization

Effective-Interest Method

Date

Cash

Paid

Interest

Expense

Premium

Amortized

Carrying

Amount of Bonds

1/1/14 $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds

12/31/14 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/15 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/16 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

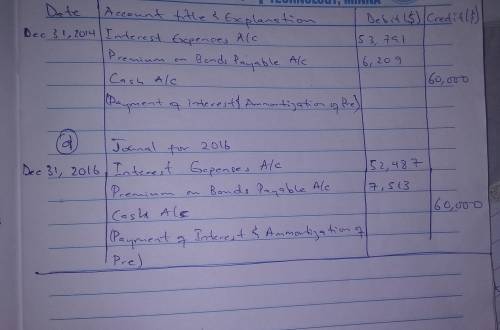

(c) Prepare the journal entry to record the interest payment and the amortization for 2014. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(d) Prepare the journal entry to record the interest payment and the amortization for 2016. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2016

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

Answers: 3

Another question on Business

Business, 22.06.2019 08:40

The following selected circumstances relate to pending lawsuits for erismus, inc. erismus’s fiscal year ends on december 31. financial statements are issued in march 2019. erismus prepares its financial statements according to u.s. gaap. required: indicate the amount erismus would record as an asset, liability, or not accrued in the following circumstances. 1. erismus is defending against a lawsuit. erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000. 2. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely. 3. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages will eventually be $5,000,000, with a present value of $3,500,000. 4. erismus is a plaintiff in a lawsuit. erismus's management believes it is probable that the company eventually will prevail in court, and that if it prevails, the judgment will be $1,000,000. 5. erismus is a plaintiff in a lawsuit. erismus’s management believes it is virtually certain that the company eventually will prevail in court, and that if it prevails, the judgment will be $500,000.

Answers: 1

Business, 22.06.2019 16:30

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

Business, 22.06.2019 20:20

Faldo corp sells on terms that allow customers 45 days to pay for merchandise. its sales last year were $325,000, and its year-end receivables were $60,000. if its dso is less than the 45-day credit period, then customers are paying on time. otherwise, they are paying late. by how much are customers paying early or late? base your answer on this equation: dso - credit period = days early or late, and use a 365-day year when calculating the dso. a positive answer indicates late payments, while a negative answer indicates early payments.a. 21.27b. 22.38c. 23.50d. 24.68e. 25.91b

Answers: 2

Business, 22.06.2019 20:20

Levine inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product. direct materials (9 pounds at $1.80 per pound) $16.20 direct labor (6 hours at $14.00 per hour) $84.00 during the month of april, the company manufactures 270 units and incurs the following actual costs. direct materials purchased and used (2,500 pounds) $5,000 direct labor (1,660 hours) $22,908 compute the total, price, and quantity variances for materials and labor.

Answers: 2

You know the right answer?

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907,...

Questions

Physics, 08.04.2021 22:10

History, 08.04.2021 22:10

Mathematics, 08.04.2021 22:10

English, 08.04.2021 22:10

Mathematics, 08.04.2021 22:10

Physics, 08.04.2021 22:10

Mathematics, 08.04.2021 22:10

History, 08.04.2021 22:10

Business, 08.04.2021 22:10

Mathematics, 08.04.2021 22:10

Mathematics, 08.04.2021 22:10