2019 2018

Business, 20.02.2020 04:02 melanieambrosy

Condensed financial data are presented below for the Phoenix Corporation:

2019 2018

Accounts receivable 267,500 $ 230,000

Inventory 312,500 257,500

Total current assets 670,000 565,000

Intangible assets 50,000 60,000

Total assets 825,000 695,000

Current liabilities 252,500 200,000

Long-term liabilities 77,500 75,000

Sales 1,640,000

Cost of goods sold 982,500

Interest expense 10,000

Income tax expense 77,500

Net income 127,500

Cash flow from operations 71,000

Cash flow from investing activities (6,000 )

Cash flow from financing activities (62,500 )

Tax rate 30 %

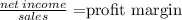

The profit margin used to calculate return on assets, operating margin, recivable turnover, return on equty and quick ratio for 2019 is

The inventory turnover for 2019 is (rounded):

Answers: 1

Another question on Business

Business, 21.06.2019 23:00

Which of the following statements is correct? a. two firms with identical sales and operating costs but with different amounts of debt and tax rates will have different operating incomes by definition. b. free cash flow (fcf) is, essentially, the cash flow that is available for interest and dividends after the company has made the investments in current and fixed assets that are necessary to sustain ongoing operations. c. retained earnings as reported on the balance sheet represent cash and, therefore, are available to distribute to stockholders as dividends or any other required cash payments to creditors and suppliers. d. if a firm is reporting its income in accordance with generally accepted accounting principles, then its net income as reported on the income statement should be equal to its free cash flow. e. after-tax operating income is calculated as ebit(1 - t) + depreciation.

Answers: 2

Business, 22.06.2019 01:30

Eliminating entries (including goodwill impairment) and worksheets for various years on january 1, 2013, porter company purchased an 80% interest in the capital stock of salem company for$850,000. at that time, salem company had capital stock of $550,000 and retained earnings of $80,000.differences between the fair value and the book value of the identifiable assets of salem company were asfollows: fair value in excess of book valueequipment$130,000land65,000inventory40,000the book values of all other assets and liabilities of salem company were equal to their fair values onjanuary 1, 2013. the equipment had a remaining life of five years on january 1, 2013. the inventory was sold in2013.salem company’s net income and dividends declared in 2013 and 2014 were as follows: year 2013 net income of $100,000; dividends declared of $25,000year 2014 net income of $110,000; dividends declared of $35,000required: a.prepare a computation and allocation schedule for the difference between book value of equity acquired andthe value implied by the purchase price.b.present the eliminating/adjusting entries needed on the consolidated worksheet for the year endeddecember 31, 2013. (it is not necessary to prepare the worksheet.)lo6lo1

Answers: 1

Business, 22.06.2019 07:30

When the national economy goes from bad to better, market research shows changes in the sales at various types of restaurants. projected 2011 sales at quick-service restaurants are $164.8 billion, which was 3% better than in 2010. projected 2011 sales at full-service restaurants are $184.2 billion, which was 1.2% better than in 2010. how will the dollar growth in quick-service restaurants sales compared to the dollar growth for full-service places?

Answers: 2

Business, 22.06.2019 11:30

11. before adding cream to a simmering soup, you need to a. simmer the cream. b. chill the cream. c. strain the cream through cheesecloth. d. allow the cream reach room temperature. student d incorrect which answer is right?

Answers: 2

You know the right answer?

Condensed financial data are presented below for the Phoenix Corporation:

2019 2018

2019 2018

Questions

Biology, 09.12.2020 20:50

Mathematics, 09.12.2020 20:50

Chemistry, 09.12.2020 20:50

Biology, 09.12.2020 20:50

Computers and Technology, 09.12.2020 20:50

Mathematics, 09.12.2020 20:50

Spanish, 09.12.2020 20:50

Mathematics, 09.12.2020 20:50

Biology, 09.12.2020 20:50

History, 09.12.2020 20:50

Mathematics, 09.12.2020 20:50

Social Studies, 09.12.2020 20:50

Physics, 09.12.2020 20:50