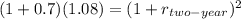

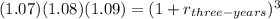

Assume that the assumptions of the Expectations Hypothesis are true and that today's one-year risk-free rate is 7%. Moreover, investors expect that the one year rate one year from now will be 8% and the one year rate two years from now will be 9%. Given this information, what should be today's two-year and three-year risk-free rates? Be precise with lots of decimals on your calculator!

Answers: 2

Another question on Business

Business, 21.06.2019 15:30

Which of the following statements accurately describes how costs and benefits are calculated?

Answers: 3

Business, 22.06.2019 03:00

How does having a flexible mind you become a better employee? a. it you become more honest toward work. b. it you become a team player. c. it you learn new things that will better your performance. d. it you to finish your work on time. e. it you reach work on time

Answers: 1

Business, 23.06.2019 09:40

When providing the square footage of a property for sale, the salesperson should disclose what?

Answers: 3

You know the right answer?

Assume that the assumptions of the Expectations Hypothesis are true and that today's one-year risk-f...

Questions

Mathematics, 04.02.2020 22:51

Mathematics, 04.02.2020 22:51

Business, 04.02.2020 22:51

Spanish, 04.02.2020 22:51

Mathematics, 04.02.2020 22:51

Mathematics, 04.02.2020 22:51

Health, 04.02.2020 22:51

World Languages, 04.02.2020 22:51

English, 04.02.2020 22:51

Mathematics, 04.02.2020 22:51

Mathematics, 04.02.2020 22:51