Business, 18.02.2020 05:17 akornegay2

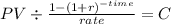

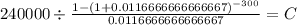

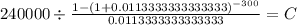

A 22-year old college graduate just got a job in Nashville. She is considering buying a house with a $240, 000 mortgage. The APR is 14% compounded monthly for her monthly mortgage payments on a 25-year fixed rate loan. If she can get her FICO score up to 750, the APR drops to 13.6%. How much in interest cost will she save over the life of the loan assuming she can increase her FICO score to 750?

Answers: 3

Another question on Business

Business, 22.06.2019 00:20

Overspeculation and a decrease in consumer confidence are both leading factors of: ?

Answers: 1

Business, 22.06.2019 20:00

Which of the following is a competitive benefit experienced by the first mover firm in an industry? a. the first mover will be able to achieve a less steep learning curve. b. the first mover will be able to reduce the switching costs. c. the first mover will not have to patent its products or technology. d. the first mover will be able to reduce costs through economies of scale.

Answers: 3

Business, 22.06.2019 20:30

When many scrum teams are working on the same product, should all of their increments be integrated every sprint?

Answers: 3

Business, 23.06.2019 07:50

Your company is starting a new r& d initiative: a development of a new drug that dramatically reduces the addiction to smoking. the expert team estimates the probability of developing the drug succesfully at 60% and a chance of losing the investment of 40%. if the project is successful, your company would earn profits (after deducting the investment) of 9,000 (thousand usd). if the development is unsuccessful, the whole investment will be lost -1,000 (thousand usd). your company's risk preference is given by the expected utility function: u(x) v1000 +x, where x is the monetary outcome of a project. calculate the expected profit of the project . calculate the expected utility of the project . find the certainty equivalent of this r& d initiative . find the risk premium of this r& d initiative e is the company risk-averse, risk-loving or risk-neutral? why do you think so?

Answers: 3

You know the right answer?

A 22-year old college graduate just got a job in Nashville. She is considering buying a house with a...

Questions

Mathematics, 16.02.2021 03:20

Mathematics, 16.02.2021 03:20

Mathematics, 16.02.2021 03:20

History, 16.02.2021 03:20

Mathematics, 16.02.2021 03:20

Mathematics, 16.02.2021 03:20

Geography, 16.02.2021 03:20

Mathematics, 16.02.2021 03:20

History, 16.02.2021 03:20

Mathematics, 16.02.2021 03:20

Physics, 16.02.2021 03:20