Business, 17.02.2020 17:17 dedrenabouyer

Consider a bond with annual coupon payments. You purchased the bond when it was originally issued. Immediately thereafter, the YTM had changed and remained at this new level indefinitely. Today, at the end of year 4 (immediately after the 4th coupon payment), your bond investment has the following characteristics:

Total Interest (Coupons) =

Interest-on-Interest (I2) =

Capital Gains =

Realized Return (annual) = $5,476.75

$1,047.89

$759.06

13.773973%

Hint: Do not assume any face value or any time to maturity at issue

You must show ALL work – including any calculator keystrokes to receive credit. Please, find

the following:

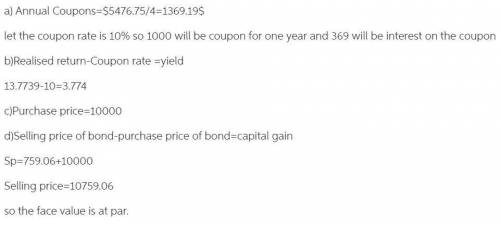

(a) The annual coupon (in dollars and cents)

(b) The new YTM (as a percentage with 3 digits after the decimal point)

(c) The purchase price of the bond (in dollars and cents)

(d) The face value of the bond (in dollars and cents)

Answers: 1

Another question on Business

Business, 22.06.2019 07:40

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 3

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 22.06.2019 17:30

Which curve shows increasing opportunity cost as you give up more of one option? demand curve bow-shaped curve yield curve indifference curve

Answers: 3

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

You know the right answer?

Consider a bond with annual coupon payments. You purchased the bond when it was originally issued. I...

Questions

Computers and Technology, 24.11.2020 17:00

Social Studies, 24.11.2020 17:00

German, 24.11.2020 17:00

Mathematics, 24.11.2020 17:00

Mathematics, 24.11.2020 17:00

Social Studies, 24.11.2020 17:00

Social Studies, 24.11.2020 17:00

Mathematics, 24.11.2020 17:00

Physics, 24.11.2020 17:00

History, 24.11.2020 17:00

Mathematics, 24.11.2020 17:00