Business, 17.02.2020 06:25 navypeanut

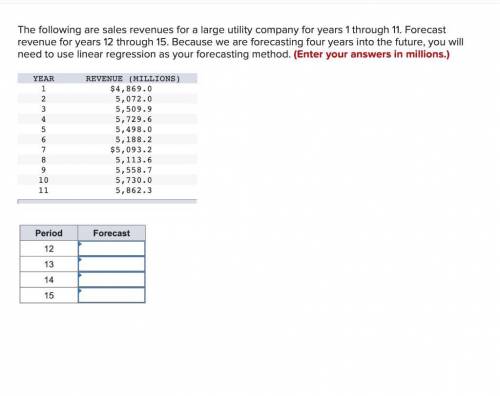

The following are sales revenues for a large utility company for years 1 through 11. Forecast revenue for years 12 through 15. Because

we are forecasting four years into the future, you will need to use linear regression as your forecasting method. (Enter your answers in

millions.)

YEAR

01 OUA

REVENUE (MILLIONS)

$4,869.

5,069.9

5,522.7

5,734.3

5,503.6

5.195.1

$5, 101.3

5,107.0

5. 552.3

5,744.8

5,863.0

Forecast

Period

12

13

15

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

Which is the correct expansion of the term internet? a. internetwork b. institutional network c. instructional network d. international network

Answers: 2

Business, 21.06.2019 23:00

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $12,500 are payable at the beginning of each year. each is a finance lease for the lessee. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) situation 1 2 3 4 lease term (years) 3 3 3 3 asset’s useful life (years) 3 4 4 6 lessor’s implicit rate (known by lessee) 14 % 14 % 14 % 14 % residual value: guaranteed by lessee 0 $ 5,000 $ 2,500 0 unguaranteed 0 0 $ 2,500 $ 5,000 purchase option: after (years) none 2 3 3 exercise price n/a $ 7,500 $ 1,500 $ 3,500 reasonably certain? n/a no no yes

Answers: 1

Business, 22.06.2019 09:00

What should a food worker use to retrieve ice from an ice machine?

Answers: 1

Business, 22.06.2019 12:10

Profits from using currency options and futures.on july 2, the two-month futures rate of the mexican peso contained a 2 percent discount (unannualized). there was a call option on pesos with an exercise price that was equal to the spot rate. there was also a put option on pesos with an exercise price equal to the spot rate. the premium on each of these options was 3 percent of the spot rate at that time. on september 2, the option expired. go to the oanda.com website (or any site that has foreign exchange rate quotations) and determine the direct quote of the mexican peso. you exercised the option on this date if it was feasible to do so. a. what was your net profit per unit if you had purchased the call option? b. what was your net profit per unit if you had purchased the put option? c. what was your net profit per unit if you had purchased a futures contract on july 2 that had a settlement date of september 2? d. what was your net profit per unit if you sold a futures contract on july 2 that had a settlement date of september 2

Answers: 1

You know the right answer?

The following are sales revenues for a large utility company for years 1 through 11. Forecast revenu...

Questions

Spanish, 08.12.2020 23:00

Mathematics, 08.12.2020 23:00

History, 08.12.2020 23:00

Mathematics, 08.12.2020 23:00

Mathematics, 08.12.2020 23:00

Advanced Placement (AP), 08.12.2020 23:00

Mathematics, 08.12.2020 23:00

Mathematics, 08.12.2020 23:00

Mathematics, 08.12.2020 23:00

Mathematics, 08.12.2020 23:00

English, 08.12.2020 23:00