Business, 15.02.2020 00:17 kimberlee304

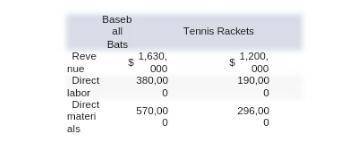

Munoz Sporting Equipment manufactures baseball bats and tennis rackets. Department B produces the baseball bats, and Department T produces the tennis rackets. Munoz currently uses plant-wide allocation to allocate its overhead to all products. Direct labor cost is the allocation base. The rate used is 150 percent of the direct labor cost. Last year, revenue, materials, and direct labor were as follows:

Required:

a. Compute the profit for each product using plant-wide allocation.

b. Maria, the manager of Department T, was convinced that tennis rackets were really more profitable than baseball bats. She asked her colleague in accounting to break down the overhead costs for the two departments. She discovered that department rates been used, Department B would have had a rate of 100 percent of the direct labor cost and Department T would have had a rate of 250 percent of the direct labor cost. Re-compute the profits for each product using each department s allocation rate (based on the direct labor cost).

Answers: 3

Another question on Business

Business, 21.06.2019 20:40

Alocal club is selling christmas trees and deciding how many to stock for the month of december. if demand is normally distributed with a mean of 100 and standard deviation of 20, trees have no salvage value at the end of the month, trees cost $20, and trees sell for $50 what is the service level?

Answers: 2

Business, 22.06.2019 02:40

Which critical success factor improves with reduced cycle time, better quality standards, and improved efficiency when an is is implemented?

Answers: 3

Business, 22.06.2019 08:00

Lavage rapide is a canadian company that owns and operates a large automatic car wash facility near montreal. the following table provides data concerning the company’s costs: fixed cost per month cost per car washed cleaning supplies $ 0.70 electricity $ 1,400 $ 0.07 maintenance $ 0.15 wages and salaries $ 4,900 $ 0.30 depreciation $ 8,300 rent $ 1,900 administrative expenses $ 1,400 $ 0.03 for example, electricity costs are $1,400 per month plus $0.07 per car washed. the company expects to wash 8,000 cars in august and to collect an average of $6.50 per car washed. the actual operating results for august appear below. lavage rapide income statement for the month ended august 31 actual cars washed 8,100 revenue $ 54,100 expenses: cleaning supplies 6,100 electricity 1,930 maintenance 1,440 wages and salaries 7,660 depreciation 8,300 rent 2,100 administrative expenses 1,540 total expense 29,070 net operating income $ 25,030 required: calculate the company's revenue and spending variances for august.

Answers: 3

Business, 22.06.2019 10:10

At the end of year 2, retained earnings for the baker company was $3,550. revenue earned by the company in year 2 was $3,800, expenses paid during the period were $2,000, and dividends paid during the period were $1,400. based on this information alone, retained earnings at the beginning of year 2 was:

Answers: 1

You know the right answer?

Munoz Sporting Equipment manufactures baseball bats and tennis rackets. Department B produces the ba...

Questions

Biology, 11.05.2021 17:00

Mathematics, 11.05.2021 17:00

Spanish, 11.05.2021 17:00

Mathematics, 11.05.2021 17:00

Mathematics, 11.05.2021 17:00

Mathematics, 11.05.2021 17:00

Mathematics, 11.05.2021 17:00

Mathematics, 11.05.2021 17:00