Business, 14.02.2020 20:52 cheycheybabygirl01

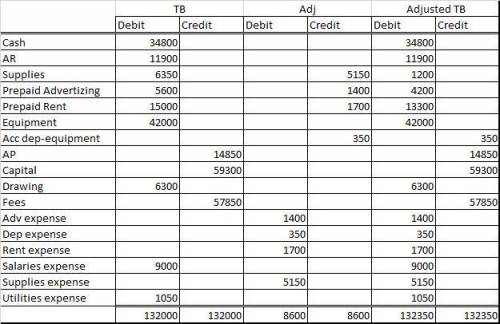

Supplies were purchased on January 1, 2019; inventory of supplies on January 31, 2019, is $1,200. The prepaid advertising contract was signed on January 1, 2019, and covers a four-month period. Rent of $1,700 expired during the month. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value.

a. Complete the worksheet for the month.

b. Prepare an income statement, statement of owner’s equity, and balance sheet. No additional investments were made by the owner during the month.

c. Journalize and post the adjusting entries.

d. If the adjusting entries had not been made for the month, would the net income be overstated or understated?

Answers: 2

Another question on Business

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 22.06.2019 20:30

Discuss ways that oracle could provide client customers with the ability to form better relationships with customers.

Answers: 3

Business, 22.06.2019 21:10

Ahospital purchases a $500,000 magnetic resonance imaging (mri) machine that has a useful life of 9 years. the salvage value at the end of 9 years is $77,000. (a) write a linear equation that describes the value y (in dollars) of the mri machine in terms of the time t (in years), 0 ≤ t ≤ 9. (b) find the value, in dollars, of the machine after 6 years. $ (c) find the time, in years, when the value of the equipment will be $140,000. (round your answer to two decimal places.) yr

Answers: 2

Business, 22.06.2019 23:50

Harris fabrics computes its predetermined overhead rate annually on the basis of direct labor-hours. at the beginning of the year, it estimated that 34,000 direct labor-hours would be required for the period’s estimated level of production. the company also estimated $599,000 of fixed manufacturing overhead expenses for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. harris's actual manufacturing overhead for the year was $768,234 and its actual total direct labor was 34,500 hours.required: compute the company's predetermined overhead rate for the year. (round your answer to 2 decimal places.)

Answers: 2

You know the right answer?

Supplies were purchased on January 1, 2019; inventory of supplies on January 31, 2019, is $1,200. Th...

Questions

Mathematics, 11.11.2020 22:30

Mathematics, 11.11.2020 22:30

Mathematics, 11.11.2020 22:30

Chemistry, 11.11.2020 22:30

Mathematics, 11.11.2020 22:30

Biology, 11.11.2020 22:30

Mathematics, 11.11.2020 22:30

Health, 11.11.2020 22:30

History, 11.11.2020 22:30

English, 11.11.2020 22:30

Social Studies, 11.11.2020 22:30

Advanced Placement (AP), 11.11.2020 22:30