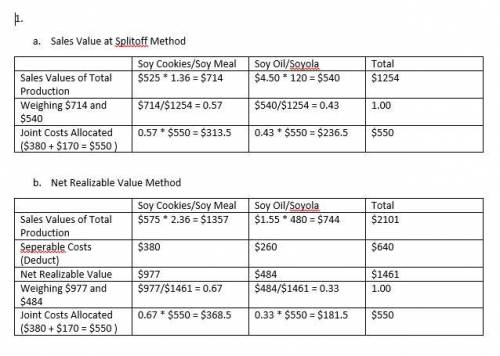

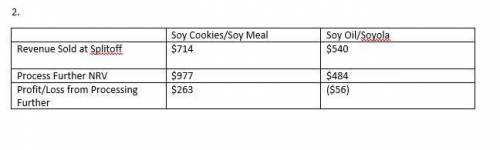

Soy Products (Upper KSP) buys soybeans and processes them into other soy products. Each ton of soybeans that Upper KSP purchases for $ 380 can be converted for an additional $ 170 into 525 lbs of soy meal and 120 gallons of soy oil. A pound of soy meal can be sold at splitoff for $ 1.36 and soy oil can be sold in bulk for $ 4.25 per gallon. Upper KSP can process the 525 pounds of soy meal into 575 pounds of soy cookies at an additional cost of $ 380. Each pound of soy cookies can be sold for $ 2.36 per pound. The 120 gallons of soy oil can be packaged at a cost of $ 260 and made into 480 quarts of Soyola. Each quart of Soyola can be sold for $ 1.55. Read the requirementsAllocate the joint cost to the cookies and the Soyola using the following:a. Sales value at splitoff methodb. NRV methodc. Should ISP have processed each of the products further? What effect does the allocation method have on this decision?

Answers: 1

Another question on Business

Business, 21.06.2019 22:40

wilson's has 10,000 shares of common stock outstanding at a market price of $35 a share. the firm also has a bond issue outstanding with a total face value of $250,000 which is selling for 102 percent of face value. the cost of equity is 11 percent while the preminustax cost of debt is 8 percent. the firm has a beta of 1.1 and a tax rate of 34 percent. what is wilson's weighted average cost of capital?

Answers: 3

Business, 22.06.2019 04:10

Universal containers(us) has an integration with its accounting system that creates tens of thousands of orders inside salesforce in a nightly batch. us wants to add automation that can attempt to match leads and contacts to these orders using the email address field on the insert. us is concerned about the performance of the automation with a large data volume. which tool should uc use to automate this process?

Answers: 1

Business, 22.06.2019 07:40

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

Business, 22.06.2019 11:30

Mark knopf is an auditor who has been asked to provide an audit and financial statement certification for a company that is going public on the new york stock exchange. knopf wants to know his personal liability if the company provides him with inaccurate or false information. which of the following sources of law will him answer that question? a. the city ordinances where the company headquarters is located. b. the state constitution of the state where the company is incorporated. c. code of federal regulations. d. all of the above

Answers: 1

You know the right answer?

Soy Products (Upper KSP) buys soybeans and processes them into other soy products. Each ton of soybe...

Questions

History, 20.07.2019 08:00

Biology, 20.07.2019 08:00

Social Studies, 20.07.2019 08:00

Social Studies, 20.07.2019 08:00

Social Studies, 20.07.2019 08:00

Social Studies, 20.07.2019 08:00

Social Studies, 20.07.2019 08:00

Social Studies, 20.07.2019 08:00

Biology, 20.07.2019 08:00

Biology, 20.07.2019 08:00

Biology, 20.07.2019 08:00

English, 20.07.2019 08:00

Biology, 20.07.2019 08:00