Assume that you are the chief financial officer at Porter Memorial Hospital. The CEO has asked to to analyze two proposed capital investments Project X and Project Y. Each project requires a net investment outlay of $10,000, and the cost of capital for each project is 12%. The projects’ expected net cash flows are;

Year Project X Project Y

0 ($10,000) ($10,000)

1 6,500 3,000

2 3,000 3,000

3 3,000 3,000

4 1,000 3,000

Question; Calculate each project’s payback period, net present value, and internal rate of return.

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

Assuming no direct factory overhead costs (i.e., inventory carry costs) and $3 million dollars in combined promotion and sales budget, the deft product manager wishes to achieve a product contribution margin of 35%. given their product currently is priced at $35.00, what would they need to limit the material and labor costs to?

Answers: 3

Business, 21.06.2019 17:00

Amarket is said to be equilibrium when quantity demanded is equal to quantity supplied. critically analyse the above statement by giving different types of market

Answers: 2

Business, 22.06.2019 09:20

Which statement best explains the relationship between points a and b? a. consumption reaches its highest point, and then supply begins to fall. b. inflation reaches its highest point, and then the economy begins to expand. c. production reaches its highest point, and then the economy begins to contract. d. unemployment reaches its highest point, and then inflation begins to decrease.

Answers: 2

You know the right answer?

Assume that you are the chief financial officer at Porter Memorial Hospital. The CEO has asked to to...

Questions

Social Studies, 18.03.2021 02:40

Computers and Technology, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

History, 18.03.2021 02:40

History, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Chemistry, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

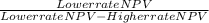

( higher rate - lower rate)

( higher rate - lower rate) (0.12-0.10) = 17.38%

(0.12-0.10) = 17.38% (0.12-0.10) = 7.54%

(0.12-0.10) = 7.54%