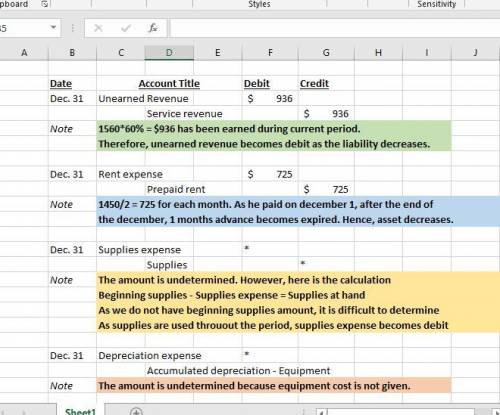

Complete the entries.12/31/2018-On December 15, Anniston contracted to perform services for a client and recorded the amount received as Unearned Revenue (amount $1,560). As of December 31, Anniston has earned 60% of this Unearned Revenue.

12/31/2018-Anniston prepaid two months of rent on December 1 ($1,450). This was debited to Prepaid Rent and is included in the Trial Balance.

12/31/2018 A physical count of supplies revealed an ending balance of $500.

12/31/2018 Anniston purchased the Equipment included on the Trial Balance on 12/1/16. The equipment has a residual value of $1,000 and is expected to last a total of 10 years. Anniston last recorded depreciation of this equipment on 12/31/17.

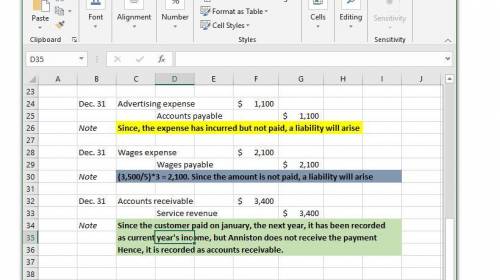

12/31/2018 Anniston received a bill for December's online advertising, $1,100. Anniston will not pay the bill until January (Anniston uses Accounts Payable for unpaid advertising).

12/31/2018Anniston pays its employees on Monday for the previous week's wages. Its employees earn $3,500 for the five-day workweek. December 31 falls on a Wednesday this year.

12/31/2018 On October 1, Anniston agreed to provide a four-month air system check beginning that day. The customer agreed to pay a total of $3,400 at the end of the four month service contract. As of December 31, Anniston has completed all work as necessary, but has not recorded any revenue to date.

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

Which type of data is generally stored in different file formats, such as text files, spreadsheets, and so on?

Answers: 3

Business, 22.06.2019 05:00

You are chairman of the board of a successful technology firm. there is a nominal federal corporate tax rate of 35 percent, yet the effective tax rate of the typical corporation is about 12.6%. your firm has been clever with use of transfer pricing and keeping money abroad and has barely paid any taxes over the last 5 years; during this same time period, profits were $28 billion. one member of the board feels that it is un-american to use various accounting strategies in order to avoid paying taxes. others feel that these are legal loopholes and corporations have a fiduciary responsibility to minimize taxes. one board member quoted what the ceo of exxon once said: “i’m not a u.s. company and i don’t make decisions based on what’s good for the u.s.” what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 2

Business, 22.06.2019 05:30

Laurelton heating & cooling installs and services commercial heating and cooling systems. laurelton uses job costing to calculate the cost of its jobs. overhead is allocated to each job based on the number of direct labor hours spent on that job. at the beginning of the current year, laurelton estimated that its overhead for the coming year would be $ 61 comma 500. it also anticipated using 4 comma 100 direct labor hours for the year. in april comma laurelton started and completed the following two jobs: (click the icon to view the jobs.) laurelton paid a $ 20-per-hour wage rate to the employees who worked on these two jobs. read the requirements requirement 1. what is laurelton's predetermined overhead rate based on direct labor hours? determine the formula to calculate laurelton's predetermined overhead rate based on direct labor hours, then calculate the rate. / = predetermined overhead rate

Answers: 2

Business, 22.06.2019 08:00

Companies in the u.s. car rental market vary greatly in terms of the size of the fleet, the number of locations, and annual revenue. in 2011 hertz had 320,000 cars in service and annual revenue of approximately $4.2 billion. the following data show the number of cars in service (1000s) and the annual revenue ($ millions) for six smaller car rental companies (auto rental news website, august 7, 2012). excel file: data14-09.xls if required, enter negative values as negative numbers. a. select a scatter diagram with the number of cars in service as the independent variable. b. what does the scatter diagram developed in part (a) indicate about the relationship between the two variables? c. use the least squares method to develop the estimated regression equation (to 3 decimals). ŷ = + x d. for every additional car placed in service, estimate how much annual revenue will change. by $ e. fox rent a car has 11,000 cars in service. use the estimated regression equation developed in part (c) to predict annual revenue for fox rent a car. round your answer to nearest whole value. $ million hide feedback partially correct

Answers: 1

You know the right answer?

Complete the entries.12/31/2018-On December 15, Anniston contracted to perform services for a client...

Questions

Physics, 07.11.2019 02:31

Mathematics, 07.11.2019 02:31

Mathematics, 07.11.2019 02:31

History, 07.11.2019 02:31

Mathematics, 07.11.2019 02:31

History, 07.11.2019 02:31