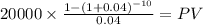

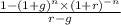

You are offered an investment in a new store. For this problem, assume away taxes. The store will sell furniture, and historically furniture prices have kept pace with inflation. The current revenue from the store is 20K a year. The current nominal interest rate is 7% and inflation is running at 3% a year. You expect this trend to continue for the 10 years of the contract. Should you make the required 140K investment?

Answers: 2

Another question on Business

Business, 21.06.2019 17:00

Herman is covered by a cafeteria plan by his employer. his adjusted gross income (agi) is $100,000. he paid unreimbursed medical premiums in the amount of $10,500 and he itemizes deductions. what amount will herman be able to deduct for his medical insurance premium expenses?

Answers: 1

Business, 22.06.2019 03:00

How could brian, who doesn't want his car insurance premiums to increase, show he poses a low risk to his insurance company? a: drive safely to avoid accidents and traffic citations b: wash and wax his car regularly to keep it clean c: allow unlicensed drivers to drive carelessly in his car d: incur driver's license points from breaking driving laws

Answers: 1

Business, 22.06.2019 03:00

Tina is applying for the position of a daycare assistant at a local childcare center. which document should tina send with a résumé to her potential employer? a. educational certificate b. work experience certificate c. cover letter d. follow-up letter

Answers: 1

Business, 22.06.2019 06:30

Double corporation acquired all of the common stock of simple company for

Answers: 2

You know the right answer?

You are offered an investment in a new store. For this problem, assume away taxes. The store will se...

Questions

Mathematics, 05.05.2020 23:21

Computers and Technology, 05.05.2020 23:21

Mathematics, 05.05.2020 23:21

English, 05.05.2020 23:21

English, 05.05.2020 23:21

History, 05.05.2020 23:21

History, 05.05.2020 23:21