Business, 12.02.2020 05:48 Gladistshiala267

Harwood Company uses a job-order costing system that applies overhead cost to jobs on the basis of machine-hours. The company's predetermined overhead rate of $2.40 per machine-hour was based on a cost formula that estimates $192,000 of total manufacturing overhead for an estimated activity level of 80,000 machine-hours.

Required:

a. Assume that during the year the company works only 78,000 machine-hours and incurs $225,000 Manufacturing Overhead. Compute the amount of overhead cost that would be applied to Work in Process for the year.

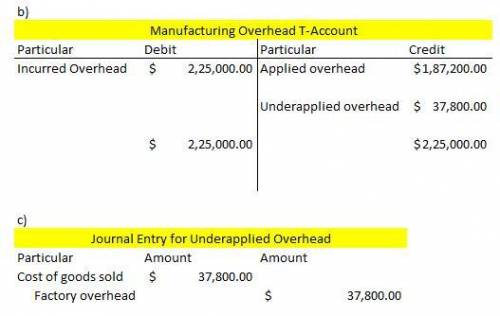

b. Compute the amount of underapplied or overapplied overhead for the year and show the balance in your Manufacturing Overhead T-account.

c. Prepare a journal entry to close the company's underapplied or overapplied overhead to Cost of Goods Sold.

Answers: 2

Another question on Business

Business, 22.06.2019 03:10

Jackson is preparing for his hearing before the federal communications commission (fcc) involving a complaint that was filed against him by the fcc regarding the interruption of radio frequency. the order to "cease and desist" using the radio frequency has had a detrimental impact on his business. once the administrative law judge prepares his or her initial order, jackson has no further options. no, jackson can request that the matter be reviewed by an agency board or commission. yes, once the initial order is presented, it's only a matter of time before the order becomes final.

Answers: 3

Business, 22.06.2019 18:00

Acountry made education free in mandatory up to age 15. it is established 100 new schools to educate kids across the country. as a result, citizens acquired the _ required to work. the school's generated _ for teachers and other staff. in 20 years, to countryside rapid _ and its gdp.

Answers: 3

Business, 22.06.2019 21:10

An investor purchases 500 shares of nevada industries common stock for $22.00 per share today. at t = 1 year, this investor receives a $0.42 per share dividend (which is not reinvested) on the 500 shares and purchases an additional 500 shares for $24.75 per share. at t = 2 years, he receives another $0.42 (not reinvested) per share dividend on 1,000 shares and purchases 600 more shares for $31.25 per share. at t = 3 years, he sells 1,000 of the shares for $35.50 per share and the remaining 600 shares at $36.00 per share, but receives no dividends. assuming no commissions or taxes, the money-weighted rate of return received on this investment is closest to:

Answers: 3

Business, 23.06.2019 04:00

Which of the following should be considered last when searching for financing

Answers: 2

You know the right answer?

Harwood Company uses a job-order costing system that applies overhead cost to jobs on the basis of m...

Questions

Physics, 02.11.2019 09:31

Computers and Technology, 02.11.2019 09:31

History, 02.11.2019 09:31

Arts, 02.11.2019 09:31

History, 02.11.2019 09:31

Mathematics, 02.11.2019 09:31

History, 02.11.2019 09:31

Biology, 02.11.2019 09:31

History, 02.11.2019 09:31

Chemistry, 02.11.2019 09:31

Chemistry, 02.11.2019 09:31

History, 02.11.2019 09:31