Business, 11.02.2020 04:02 mathman783

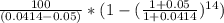

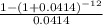

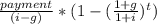

An investor purchases an annuity that will pay a constant payment starting today of $100. Beginning with the payment 12 years from today each payment will be 5% greater than the previous payment. The last payment will be received 25 years from today. The annuity is bought to yield an effective interest rate of i such that (vi)^4 = 0.85.

A. What is the purchase price of the annuity today?

Answers: 1

Another question on Business

Business, 22.06.2019 07:00

Amarket that consists of all possible consumers regardless of their specific needs or wants is a

Answers: 1

Business, 22.06.2019 08:30

Match the given situations to the type of risks that a business may face while taking credit. 1. beta ltd. had taken a loan from a bank for a period of 15 years, but its sales are gradually showing a decline. 2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any research before making this decision. 3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession. 4. delphi ltd. has taken a short-term loan from the bank, but its supply chain logistics are not in place. a. foreign exchange risk b. operational risk c. term of loan risk d. revenue projections risk

Answers: 3

Business, 22.06.2019 22:00

Which of the following is a function performed by market prices? a. market prices communicate information to buyers and sellers. b. market prices coordinate the decisions of buyers and sellers. c. market prices motivate entrepreneurs to produce those products that are currently most desired relative to their costs of production. d. all of the above are functions performed by market prices.

Answers: 2

You know the right answer?

An investor purchases an annuity that will pay a constant payment starting today of $100. Beginning...

Questions

Mathematics, 31.12.2021 03:50

Physics, 31.12.2021 03:50

Social Studies, 31.12.2021 04:00

Mathematics, 31.12.2021 04:00

Mathematics, 31.12.2021 04:00

Chemistry, 31.12.2021 04:00

Chemistry, 31.12.2021 04:00

Social Studies, 31.12.2021 04:00

Chemistry, 31.12.2021 04:00

History, 31.12.2021 04:00

.............1

.............1

- 1

- 1  × (1+i) .................2

× (1+i) .................2 × ( 1 + 4.14 % )

× ( 1 + 4.14 % ) ............3

............3